TL;DR

- Stripe operates in only 46 countries, PayPal bans 15 nations entirely

- Stablecoins processed $8.9 trillion in H1 2025 alone more than Visa and Mastercard combined

- GENIUS Act (US) and MiCA (EU) passed in 2025 providing federal regulatory frameworks that eliminate compliance uncertainty.

- Implementation takes 2-4 weeks versus 6-18 months for traditional processor new market setup.

- Real enterprise adoption accelerating rapidly: 25% of Fireblocks invoices settle in stablecoins

- Strategic market entry methodology proven: Pilot program in one blocked market (4-8 weeks), measure performance and refine processes, then scale to additional markets

Stripe, positioned as the global payment platform powering internet businesses worldwide, operates in exactly 46 fully supported countries. Not 195. Not even 100. Just 46.

PayPal reaches 200+ countries but supports only 25 currencies and completely bans 15 nations including Pakistan, Myanmar, and Venezuela. India, the world’s most populous nation, can receive international PayPal payments but cannot make domestic transfers.

For e-commerce CFOs building international expansion strategies, “global” payment processors often say no to the exact markets representing highest growth potential. Southeast Asia, where 60-70% lack traditional bank accounts but own mobile phones. Latin America, where cross-border e-commerce is growing explosively. Africa, where mobile money has leapfrogged legacy banking infrastructure.

Stripe operates in 46 countries, leaving 149 nations without access to ‘global’ payment infrastructure.

Yet in the first half of 2025 alone, stablecoins processed $8.9 trillion in transaction volume. That’s more than Visa and Mastercard combined during the same period. And 86% of financial institutions report their infrastructure is now ready for stablecoin adoption.

This creates a counterintuitive opportunity: when traditional payment processors block market access, regulated stablecoin infrastructure opens pathways into previously inaccessible regions.

The question isn’t whether stablecoins are legitimate, 23% of CFOs expect to adopt them within two years, jumping to 39% for companies with $10 billion+ revenue. The question is whether your international expansion strategy accounts for payment infrastructure that operates beyond traditional processor limitations.

Mapping the Geographic Exclusion: Where Traditional Processors Actually Operate

Before discussing alternatives, let’s establish precisely where traditional payment processors operate and where they don’t.

Stripe’s Actual 46-Country Reality

The Geographic Truth:

Stripe supports businesses in exactly 46 countries where companies can create accounts immediately. Five additional countries are accessible through their Paystack acquisition (Nigeria, Kenya, Ghana, South Africa, Côte d’Ivoire), and two markets, India and Indonesia, operate as “preview” territories requiring direct sales team approval.

Regional Distribution Breakdown:

- Europe: 28 countries (strongest coverage)

- Asia-Pacific: 9 countries (significant gaps)

- North America: 3 countries (US, Canada, Mexico)

- Latin America: 2 countries (Brazil, Mexico only)

- Middle East: 1 country (UAE exclusively)

- Africa: Accessible only through Paystack partnership

That means 149 countries remain outside Stripe’s direct coverage. For businesses targeting high-growth emerging markets, this creates immediate expansion barriers.

PayPal’s Currency Paradox

The 200 vs. 25 Limitation:

PayPal operates in over 200 countries and territories but supports transactions in only 25 currencies. This creates a fundamental disconnect: geographic presence without currency flexibility.

Complete Ban List (15 Countries):

Afghanistan, Belarus, Iran, Iraq, Myanmar, North Korea, Pakistan, Syria, Libya, Venezuela, Zimbabwe, Cuba, Serbia & Montenegro, Liberia.

Functional Restrictions:

- Turkey: Completely banned since 2016 due to data localization requirements

- India: Can receive international payments but cannot make domestic transfers

- Kazakhstan: Account holders cannot withdraw funds

- Russia: Services suspended in 2022

For a SaaS company wanting to serve Southeast Asian customers or an e-commerce platform expanding into Latin America, these limitations eliminate entire market segments regardless of business opportunity.

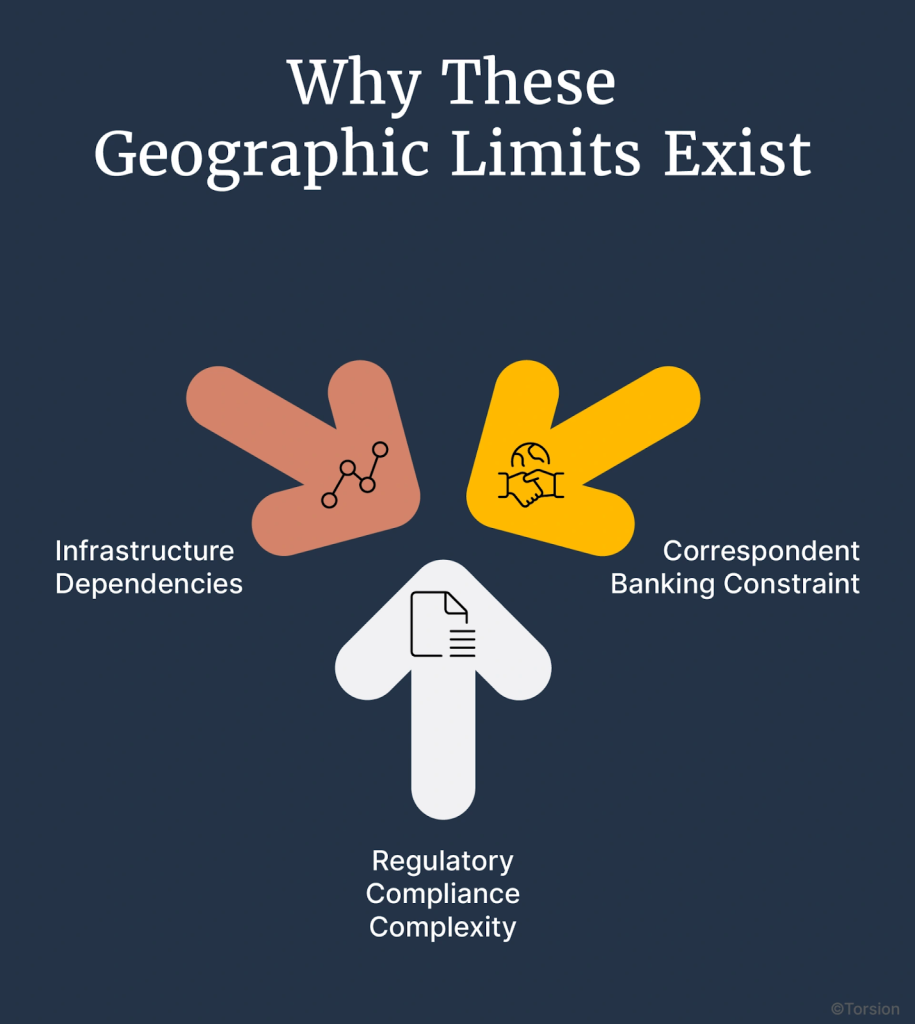

Why These Geographic Limits Exist

The Correspondent Banking Constraint:

Traditional payment processors depend on correspondent banking relationships. Your payment doesn’t travel directly but routes through intermediary banks that maintain relationships in destination countries. Building these relationships takes years and requires regulatory approval in each jurisdiction.

Regulatory Compliance Complexity:

Different countries mandate different data localization requirements, AML/KYC procedures, and compliance frameworks. Traditional processors approach new markets conservatively, expanding only when regulatory certainty and banking infrastructure justify the operational investment.

Infrastructure Dependencies:

Payment processors require local banking partnerships, currency exchange capabilities, and established settlement mechanisms. In markets where these don’t exist robustly, processors simply don’t operate.

These aren’t temporary limitations. They’re structural constraints built into correspondent banking architecture designed decades ago for a different era of international commerce.

The Growth Opportunity Beyond Payment Processor Coverage

The markets traditional processors exclude or limit aren’t niche. They represent some of the world’s highest-growth e-commerce regions.

Southeast Asia: Mobile-First Commerce Without Banking Infrastructure

Market Characteristics:

Between 60-70% of Southeast Asian populations lack traditional bank accounts, but mobile phone penetration approaches universal coverage. Consumers prefer payment methods like GCash, GrabPay, and mobile money systems that leapfrog legacy banking.

E-commerce Growth Trajectory:

Cross-border e-commerce in the Asia-Pacific region is experiencing explosive growth, but Western payment processors struggle with market-specific requirements. Stripe covers only 9 countries in the entire Asia-Pacific region. Many high-growth markets remain completely inaccessible.

Latin America: Cross-Border Commerce Meets Payment Infrastructure Gaps

Digital Commerce Expansion:

Cross-border e-commerce in Latin America is projected to exceed $100 billion by 2026, growing at double-digit annual rates. Yet traditional payment processors serve only Brazil and Mexico in the entire region.

Stablecoin Adoption Response:

Latin American businesses have responded with 200%+ growth in stablecoin payment volume, demonstrating market demand for payment infrastructure that operates beyond traditional processor limitations.

Africa: The Leapfrog Opportunity

Mobile Money Dominance:

In Kenya, Rwanda, Tanzania, and Uganda combined, 66% of the adult population uses mobile money. Cash-on-delivery still accounts for nearly 50% of e-transaction value by volume. Traditional Western payment processors have minimal presence across most of the continent.

Market Access Challenge:

For businesses wanting to serve African customers, traditional payment infrastructure simply doesn’t reach most markets. Alternative payment methods aren’t optional, they’re mandatory for market entry.

The markets growing fastest are often the same markets traditional payment processors don’t adequately serve. This creates a strategic disconnect: growth opportunity exists where payment infrastructure doesn’t.

Traditional Workarounds: Why Alternative Approaches Fall Short

When confronted with payment processor geographic limitations, businesses typically attempt three workarounds. Each has significant drawbacks.

The Multi-Processor Strategy

The Approach:

Use Stripe for North America and Europe, PayPal for broader geographic reach, regional processors for specific markets, and local payment method integrations for country-specific requirements.

Why It Fails at Scale:

Even combining Stripe and PayPal leaves major markets uncovered. Each processor requires separate integration, different reconciliation processes, and distinct settlement timelines. The operational complexity of managing multiple payment rails increases with each geographic market.

Your finance team reconciles payments across different systems with different reporting formats. Your development team maintains separate integrations for each processor. Your treasury team manages working capital across multiple settlement accounts with different timing.

The technical overhead and operational burden make this approach viable only for specific corridor solutions, not scalable global infrastructure.

Local Payment Method Integration

The Approach:

Integrate region-specific payment methods individually, WeChat Pay and Alipay for China, PIX for Brazil, M-Pesa for Kenya, GCash for Philippines, and dozens of others for comprehensive coverage.

The Scaling Problem:

Each payment method requires separate technical integration, ongoing maintenance, security updates, and compliance monitoring. Your technical team becomes payment integration specialists rather than focusing on core product development.

Security considerations multiply and each integration represents a potential attack surface. Compliance requirements differ by payment method and jurisdiction. The maintenance burden grows linearly with each market entry.

Regional Partnership Dependencies

The Approach:

Establish banking partnerships in target markets, work with local payment processors, and build market-specific infrastructure through regional relationships.

The Strategic Constraint:

Partnerships limit scalability and each market requires separate relationship development. Revenue sharing reduces margins. You’re dependent on partner capabilities, strategic priorities, and operational reliability.

Geographic expansion speed is constrained by partnership development timelines. You don’t control the payment infrastructure; you access it through intermediaries who may have conflicting strategic priorities.

None of these workarounds provide what international expansion requires: unified payment infrastructure that operates globally without geographic artificial barriers imposed by correspondent banking limitations.

Stablecoin Market Entry Framework: The Alternative Infrastructure

Here’s what changes when payment infrastructure operates on blockchain rails rather than correspondent banking networks.

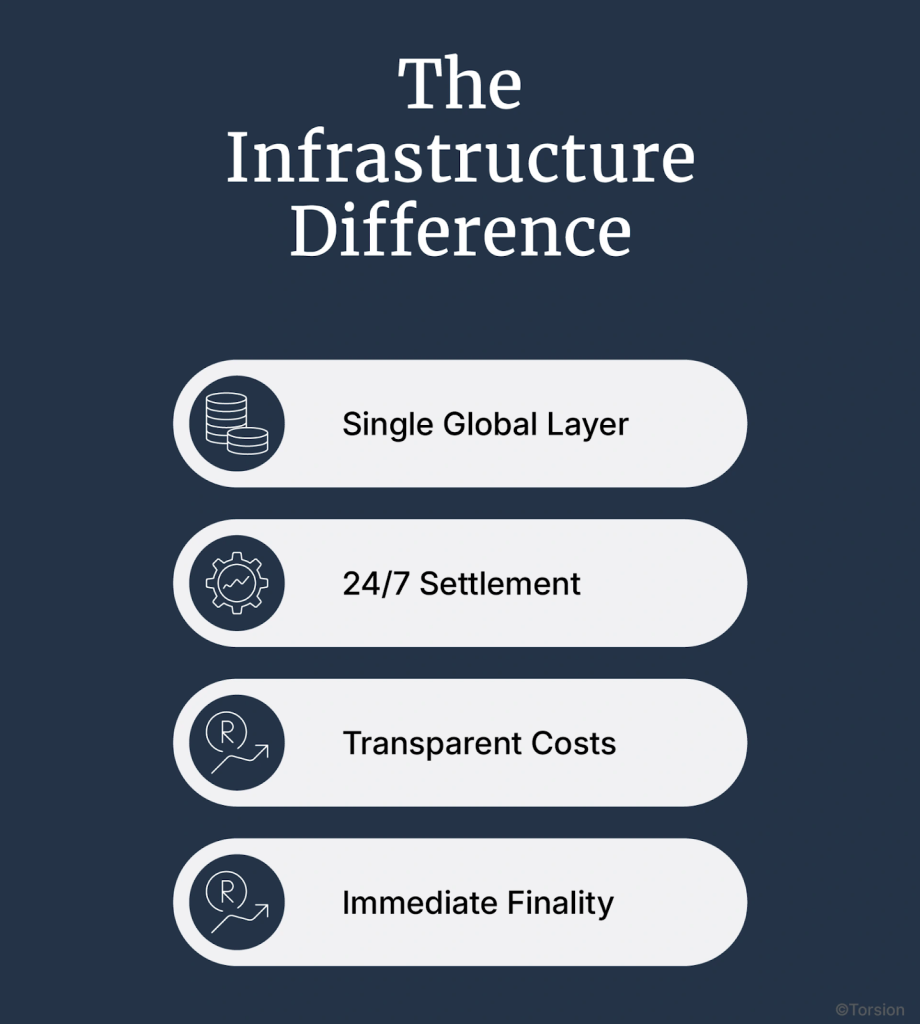

The Infrastructure Difference

Single Global Layer:

Stablecoins operate on distributed blockchain networks accessible globally. There’s no correspondent bank chain determining which markets are “supported.” The infrastructure itself has no geographic restrictions, only regulatory frameworks and local conversion partnerships vary by jurisdiction.

24/7 Settlement:

Traditional banking operates on business hours within each timezone. International payments route through multiple banks, each with separate processing windows. Stablecoins settle 24/7 without banking hour restrictions.

Transparent Costs:

Blockchain transaction fees are disclosed upfront and don’t vary based on transaction destination. No hidden FX markups embedded in exchange rates. No surprise intermediary bank cuts discovered only after settlement.

Immediate Finality:

Same-day settlement eliminates the 2-5 day working capital float traditional international wires create. Payment confirmation is immediate, not dependent on correspondent banking processing timelines.

Regulatory Maturity Enabling Enterprise Adoption

The 2025 Compliance Framework:

Three major regulatory frameworks passed in 2025 transform stablecoins from experimental technology to regulated financial infrastructure.

GENIUS Act (United States):

Signed into law July 2025, the GENIUS Act provides federal regulatory clarity for stablecoin issuers and users. This eliminates the regulatory uncertainty that previously prevented enterprise CFO adoption. Stablecoins operating under GENIUS Act frameworks have clear compliance requirements and legal standing.

MiCA Framework (European Union):

The Markets in Crypto-Assets regulation establishes comprehensive stablecoin oversight across EU member states. Stablecoin issuers must maintain reserves, undergo regular audits, and comply with established financial regulation frameworks.

Hong Kong Stablecoin Framework:

Effective August 2025, Hong Kong’s regulatory approach provides Asia-Pacific businesses with clear compliance pathways for stablecoin operations. Singapore maintains mature regulatory oversight through MAS.

What This Means for CFOs:

These aren’t proposals or draft frameworks. They’re enacted regulations with established compliance procedures. The regulatory uncertainty that previously blocked CFO consideration no longer exists in major jurisdictions.

Enterprise Infrastructure Requirements

What “Enterprise-Grade” Actually Means:

Not all stablecoin infrastructure meets enterprise requirements. CFOs evaluating stablecoin adoption need specific infrastructure characteristics.

Reserve Backing and Attestations:

USDC maintains 61% reserves in cash and government money market funds, 12% in US Treasuries, with monthly attestations from Big 4 accounting firms. USDT provides regular reserve reports. This isn’t trust-based, it’s audit-based.

Institutional Custody Solutions:

Enterprise stablecoin operations require regulated custodians like Fireblocks or Anchorage with SOC2 Type II certification, institutional insurance, and established security protocols. Your treasury team doesn’t manage private keys, regulated custodians do.

AML/KYC Integration:

Transaction monitoring through providers like Chainalysis and TRM Labs ensures compliance with established AML/KYC requirements. Blockchain transparency actually enhances compliance monitoring compared to traditional payment systems.

ERP System Integration:

Stablecoin payment infrastructure must integrate with existing enterprise systems like NetSuite, SAP, QuickBooks, Xero through standard APIs. Finance teams continue using familiar workflows while gaining access to blockchain settlement.

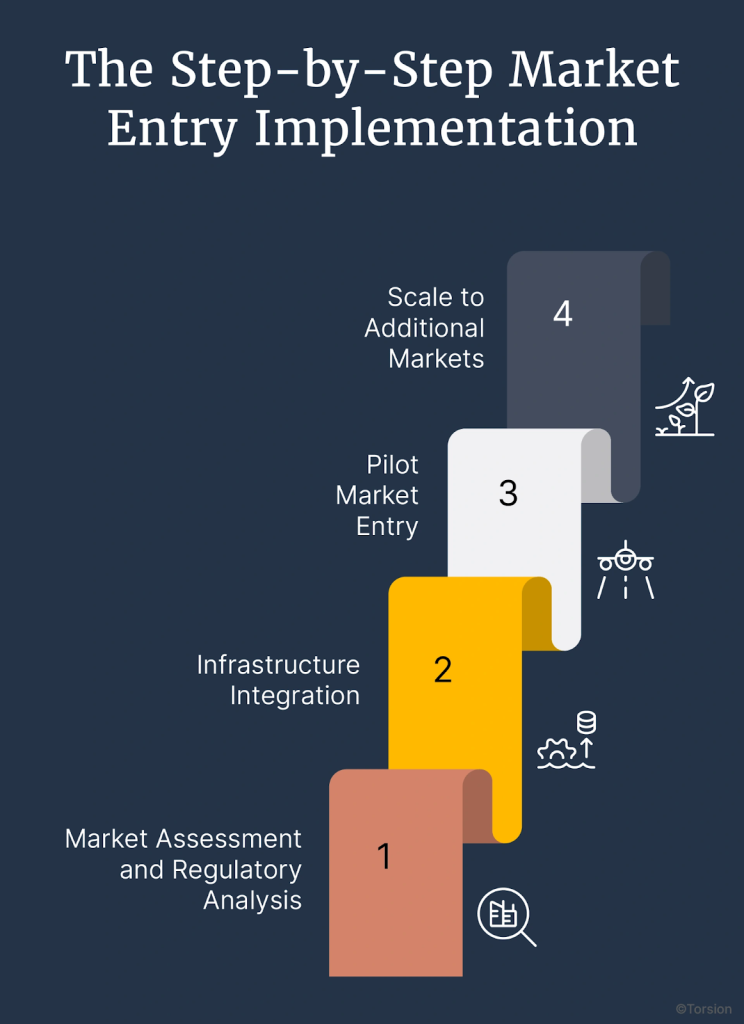

The Step-by-Step Market Entry Implementation

Theory matters less than implementation. Here’s the actual methodology for entering blocked markets through stablecoin infrastructure.

Step 1: Market Assessment and Regulatory Analysis

Target Market Selection:

Which markets represent highest revenue opportunity but remain blocked by traditional processors? Southeast Asian markets Stripe doesn’t serve? African countries PayPal bans? Latin American nations with limited payment infrastructure?

Regulatory Compliance Mapping:

What stablecoin regulations apply in target markets? Do GENIUS Act, MiCA, or regional frameworks provide compliance pathways? What local business licensing requirements exist regardless of payment method?

Customer Payment Preference Research:

Do target market customers understand and accept stablecoin payments? What local fiat conversion partnerships exist for customer on-ramps? How do competitors handle payment challenges in these markets?

Financial Impact Modeling:

What incremental revenue does market access enable? What are implementation costs versus traditional payment infrastructure? How does cost structure compare to existing international payment expenses?

Step 2: Infrastructure Integration

Technical Implementation:

Basic stablecoin payment acceptance integrates in approximately one week. Full enterprise deployment with ERP integration, automated reconciliation, and treasury system connectivity requires 2-4 weeks depending on existing technical infrastructure.

Custody and Security Setup:

Establish relationships with regulated custodians. Implement transaction monitoring and compliance reporting systems. Integrate AML/KYC procedures with existing compliance frameworks.

Accounting and Reporting Configuration:

Configure stablecoin holdings as cash equivalents in financial reporting systems. Set up automated reconciliation between blockchain transactions and internal accounting records. Establish audit trail documentation procedures.

Finance Team Training:

Train treasury, accounting, and operations teams on stablecoin payment procedures. Most teams adapt quickly because from their perspective, it’s a new payment method with better settlement timing, not a cryptocurrency trading operation.

Step 3: Pilot Market Entry

Limited Scope Testing:

Launch stablecoin payments in one target market or customer segment. Test conversion rates, transaction success, customer support requirements, and operational procedures before broader deployment.

Performance Measurement:

Track customer acquisition costs, conversion rates, transaction volumes, and revenue impact. Compare actual results to projections. Identify operational refinements needed before scaling.

Compliance Validation:

Confirm regulatory procedures work as designed. Validate reporting, audit trails, and compliance documentation satisfy requirements. Adjust processes based on pilot learnings.

Stakeholder Feedback:

Gather input from finance, operations, customer support, and sales teams. Refine procedures based on operational experience before expanding to additional markets.

Step 4: Scale to Additional Markets

Geographic Expansion:

Based on pilot success, expand stablecoin payment acceptance to additional blocked markets. Each subsequent market benefits from operational procedures refined during the pilot.

Continuous Optimization:

Monitor performance metrics, optimize conversion flows, refine customer support procedures, and identify additional market entry opportunities enabled by global payment infrastructure.

The difference in market entry speed isn’t marginal. It’s measured in months and quarters that determine competitive positioning in high-growth markets.

Real-World Application: How This Actually Works

Abstract frameworks matter less than concrete implementation. Here’s how businesses use stablecoin infrastructure for market entry.

E-commerce Platform: Southeast Asia Expansion

The Market Entry Challenge:

An e-commerce platform wanted to serve customers across Southeast Asian markets where Stripe doesn’t operate and PayPal has limited functionality. Traditional alternatives required market-by-market integration of different payment methods with separate processors.

Stablecoin Solution:

USDC payment infrastructure provided single integration serving multiple blocked markets. Customers pay in local currencies through conversion partners while the platform receives stablecoin settlement. Same-day finality eliminates multi-day working capital float.

Measurable Results:

Market entry within 3 weeks versus 6+ months for traditional processor setup. Unified payment infrastructure across previously blocked markets. 50%+ lower payment processing costs versus multi-processor workaround approaches.

SaaS Subscription: Latin American Customer Base

The Recurring Payment Problem:

A SaaS company wanted to serve Latin American customers but faced currency volatility challenges, payment processor restrictions in multiple countries, and recurring billing complexity across different payment infrastructure.

Stablecoin Implementation:

USDT-enabled subscription billing provides predictable pricing in stable-value denominations. Customers in previously blocked markets can now subscribe. Monthly recurring revenue collection happens without currency fluctuation impact on financial planning.

Business Impact:

Addressable market expanded to include previously inaccessible countries. Predictable revenue collection eliminates FX volatility complications in monthly financial close. Customer acquisition costs lower due to expanded geographic reach.

B2B Marketplace: African Supplier Network

The Cross-Border Payment Barrier:

A B2B marketplace connecting buyers with African suppliers faced impossible economics, traditional wire transfers cost $45-140 per transaction, taking 2-5 days to settle. For smaller transaction values, payment costs exceeded acceptable percentages.

Stablecoin Payment Rails:

Blockchain-based supplier payments through stablecoin infrastructure reduced per-transaction costs below $5 with same-day settlement. Suppliers receive instant payment confirmation. Working capital isn’t tied up in multi-day international wires.

Operational Transformation:

80%+ payment cost reduction versus traditional wire transfers. Instant settlement improves supplier relationships and negotiating leverage. Previously uneconomical transaction sizes become viable with sub-$5 processing costs.

Navigating the Compliance Framework: What CFOs Actually Need to Know

Regulatory compliance is the enabling framework that makes enterprise adoption possible.

Accounting Treatment and Financial Reporting

Balance Sheet Classification:

Stablecoins held for payment operations classify as cash equivalents under standard GAAP and IFRS frameworks. They’re not crypto trading positions, they’re payment infrastructure that happens to use blockchain settlement.

Audit Trail Requirements:

Blockchain provides immutable transaction records superior to traditional payment documentation. Every transaction has permanent, verifiable proof. Auditors receive more comprehensive documentation than traditional banking provides.

Tax Implications:

Stablecoin payments follow the same tax treatment as foreign currency transactions. There’s no special crypto tax category for payment operations. Standard 1099 reporting procedures apply with established frameworks.

What Auditors Need:

Transaction IDs providing blockchain verification, monthly reserve attestations from stablecoin issuers, custody confirmation from regulated partners, and standard KYC documentation. Most audit firms have established procedures for stablecoin payment verification.

Risk Management Framework

Reserve Risk Assessment:

Major stablecoins maintain 1:1 backing by cash and US Treasury bills with monthly Big 4 auditor attestations. This provides more frequent verification than most traditional banking relationships. De-pegging risk for major stablecoins has been negligible over multi-year operational history.

Custody and Security:

Enterprise custody solutions provide institutional insurance, multi-signature security protocols, and regulatory oversight. Treasury teams don’t manage blockchain infrastructure directly, regulated custodians handle technical operations.

Operational Controls:

Transaction limits, approval workflows, and segregation of duties mirror traditional payment controls. Blockchain settlement happens faster, but approval procedures remain under finance team control.

Counterparty Risk:

Same-day settlement eliminates the multi-day counterparty exposure traditional international payments create. Funds settle immediately rather than spending 2-5 days in correspondent banking chains.

Regulatory Compliance by Jurisdiction

United States Operations:

GENIUS Act provides federal framework with clear compliance requirements. Businesses using stablecoins for payment operations follow established AML/KYC procedures with defined regulatory oversight.

European Union Access:

MiCA framework establishes stablecoin regulation across EU member states. Businesses operating under MiCA have clear licensing requirements and regulatory procedures for compliant operations.

Asia-Pacific Markets:

Hong Kong and Singapore provide mature regulatory frameworks. Other Asia-Pacific markets have varying approaches, regulatory analysis is market-specific and evolving as stablecoin adoption accelerates.

Emerging Markets:

Regulatory frameworks vary significantly by country. Some embrace stablecoins as payment infrastructure enabling financial inclusion. Others maintain capital controls or restrictions. Market entry requires jurisdiction-specific regulatory assessment.

The regulatory maturity achieved in 2025 transforms stablecoins from experimental technology to compliant financial infrastructure that CFOs can evaluate using established risk management frameworks.

The Strategic Advantage: Why Market Entry Timing Matters

First-mover advantages in underserved markets compound over time. Competitive positioning in high-growth regions creates strategic value beyond immediate revenue impact.

Customer Acquisition Economics

Reduced Competition in Blocked Markets:

When traditional payment processors exclude markets, fewer competitors serve those regions. Customer acquisition costs in underserved markets often run significantly below mature markets where competition is intense.

Brand Positioning Benefits:

Being among the first to serve previously blocked markets creates brand equity and customer loyalty. Customers remember businesses that served them when others wouldn’t or couldn’t.

Network Effects in Marketplace Models:

For marketplace or platform businesses, early market entry enables network effect development before competitors arrive. First businesses to establish liquidity in two-sided markets gain sustainable advantages.

Operational Flexibility

Infrastructure Portability:

Once stablecoin payment infrastructure is operational, adding new markets doesn’t require separate integrations. The same infrastructure serves multiple blocked markets and geographic expansion becomes configuration rather than development.

Working Capital Efficiency:

Same-day settlement improves working capital management. Capital isn’t tied up in multi-day international wire transfers. Treasury teams have more flexibility for strategic capital deployment.

Supplier Relationship Leverage:

Ability to pay suppliers instantly, even across borders, creates negotiating advantages for pricing, payment terms, and priority fulfillment. Traditional wire transfers taking 2-5 days don’t provide this leverage.

Competitive Differentiation

Market Access as Strategic Capability:

While competitors wait for traditional processors to expand coverage, businesses with stablecoin infrastructure access high-growth markets immediately. This isn’t a temporary advantage, it’s infrastructure-based competitive positioning.

Technology Leadership Signaling:

Early adoption of regulated alternative payment infrastructure signals technology sophistication to investors, partners, and customers. It demonstrates strategic agility and willingness to evaluate emerging solutions.

M&A and Valuation Impact:

Businesses serving broader geographic markets command higher valuations. Payment infrastructure that enables global operations without artificial geographic constraints increases strategic value to potential acquirers.

The Implementation Decision: What CFOs Should Evaluate

Not every business needs stablecoin infrastructure immediately. Here’s the decision framework for evaluating whether market entry through alternative payment rails makes strategic sense.

When Stablecoin Market Entry Makes Strategic Sense

Target Market Inaccessibility:

Traditional payment processors block or significantly restrict access to markets representing high revenue potential. Alternative payment infrastructure isn’t an optimization, it’s a requirement for market entry.

High Growth Opportunity:

Target markets show strong growth trajectories with limited payment infrastructure competition. Early market entry enables competitive positioning before traditional processors expand coverage (if they ever do).

Regulatory Framework Exists:

Target markets have clear stablecoin regulatory frameworks or don’t prohibit their use. GENIUS Act, MiCA, or regional regulations provide compliance pathways for legitimate business operations.

Customer Base Readiness:

Target market customers understand and accept alternative payment methods. In many emerging markets, customers are more familiar with mobile money and digital currencies than traditional credit cards.

Business Model Economics:

Implementation investment justified by revenue opportunity in blocked markets. For businesses targeting multiple restricted markets, unified payment infrastructure provides better economics than market-by-market integration.

The ROI Calculation Framework

Implementation Costs:

Technical integration (2-4 weeks of development), custody and compliance setup, finance team training, and initial market entry operations. For most mid-market and enterprise businesses, implementation costs represent 4-8 weeks of loaded team expenses.

Operational Cost Structure:

Stablecoin payment processing runs sub-1% transaction costs with transparent fees versus 3-8% total costs for traditional international payments including wire fees, FX markups, and working capital expenses.

Revenue Opportunity:

What incremental revenue does market access enable? How many customers in blocked markets represent addressable opportunities? What customer lifetime value justifies market entry investment?

Competitive Advantage Timeline:

How long before traditional processors expand to target markets (if ever)? What first-mover advantages exist from early market entry? How does competitive positioning compound over time?

Strategic Option Value:

Beyond immediate revenue, what strategic optionality does global payment infrastructure create? How does geographic flexibility affect future expansion decisions and competitive positioning?

Risk-Adjusted Decision Making

Phased Implementation Approach:

Start with pilot program in one high-opportunity blocked market. Validate operational procedures, measure performance, refine processes. Expand to additional markets based on pilot learnings.

Regulatory Monitoring:

Stablecoin regulation continues evolving. Implementation should include ongoing regulatory monitoring and compliance adaptation as frameworks mature in different jurisdictions.

Infrastructure Scalability:

Evaluate whether initial implementation scales to additional markets or requires repeated integration work. Unified global infrastructure provides better long-term economics than market-specific implementations.

Team Capability Requirements:

Does your finance and operations team have capacity for alternative payment infrastructure integration? Implementation requires 4-8 weeks of focused effort, is that feasible within current priorities?

The Competitive Reality: What’s Happening While You Evaluate

This isn’t theoretical future planning. These decisions are being made now, and competitive positioning is evolving based on payment infrastructure choices.

Enterprise Adoption Acceleration

The Tipping Point Data:

25% of Fireblocks invoices already settle in stablecoins. That’s enterprise software infrastructure companies, not crypto-native businesses, using stablecoins for routine B2B payment settlement.

58% of European financial institutions are using or actively planning stablecoin payment integration. These aren’t small startups, these are established financial institutions adapting payment infrastructure for competitive advantage.

CFO Adoption Timeline:

23% of CFOs expect stablecoin adoption within 2 years. For companies with $10 billion+ revenue, that percentage jumps to 39%. This isn’t speculative interest, it’s implementation planning based on regulatory clarity and infrastructure maturity.

The Strategic Window

Regulatory Maturity Creates Opportunity:

GENIUS Act passage in July 2025 eliminates the regulatory uncertainty that prevented enterprise CFO consideration. MiCA framework in Europe provides similar compliance clarity. The regulatory barriers that existed 12-18 months ago no longer apply in major jurisdictions.

Infrastructure Readiness:

86% of financial institutions report their infrastructure is ready for stablecoin adoption. The technical integration challenges that complicated early adoption have been solved through standardized enterprise integration patterns.

First-Mover Window Closing:

As more businesses adopt stablecoin payment infrastructure for blocked market entry, first-mover advantages in underserved markets diminish. The strategic window for competitive differentiation through payment infrastructure narrows as mainstream adoption accelerates.

Your competitors are evaluating the same strategic opportunities and payment infrastructure limitations. Some are moving forward with stablecoin market entry. Others are accepting traditional processor constraints and adjusting expansion strategies accordingly.

The cost of delay is the cumulative impact of blocked market opportunities, competitive positioning in high-growth regions, and strategic flexibility that compounds over quarters and years.

The Path Forward: From Evaluation to Implementation

International expansion through stablecoin payment infrastructure isn’t speculation. It’s strategic infrastructure adoption enabled by 2025 regulatory maturity.

The Implementation Reality

Traditional payment processors operate in 46 countries (Stripe) or support 25 currencies (PayPal). These aren’t temporary limitations, they’re structural constraints built into correspondent banking architecture designed for a previous era of international commerce.

Stablecoin infrastructure processed $8.9 trillion in transaction volume in the first half of 2025 alone. This demonstrates enterprise-scale capabilities, not experimental technology. The regulatory frameworks enabling compliant operations now exist in major jurisdictions.

For CFOs evaluating international expansion: the question isn’t whether stablecoins are legitimate payment infrastructure. The data confirms they are. The question is whether your growth strategy accounts for payment infrastructure that operates beyond traditional processor geographic limitations.

The Competitive Imperative

While one business waits for traditional processors to expand coverage, another accesses blocked markets through alternative infrastructure. While one CFO deliberates on regulatory frameworks, another operates under GENIUS Act and MiCA compliance. While one company maintains correspondent banking relationships, another settles payments same-day on blockchain rails.

These decisions create competitive positioning that compounds over time. First-mover advantages in underserved markets, operational efficiency from same-day settlement, and strategic flexibility from infrastructure not constrained by correspondent banking limitations.

Your Next Decision Point

The regulatory maturity, infrastructure readiness, and enterprise adoption acceleration happening in 2025 create a strategic decision point.

Continue with payment infrastructure that blocks access to high-growth markets while waiting for traditional processors to expand (which may never happen).

Or implement alternative infrastructure that provides immediate market access, operates under established regulatory frameworks, and integrates with existing enterprise financial systems in 2-4 weeks.

The markets aren’t waiting. The competition isn’t waiting. The strategic window for first-mover advantages in underserved markets narrows as mainstream adoption accelerates.

Your international expansion strategy deserves payment infrastructure built for international expansion, not constrained by correspondent banking limitations designed for a previous era.