Key Takeaways

- Massive Market Growth: The generative AI in the insurance sector is exploding. Projections show the market soaring to $14.3 billion by 2033, signaling a seismic shift in the industry’s technological landscape.

- A Competitive Imperative: Top insurance executives are in agreement: rapid adoption of generative AI is no longer optional, but essential to compete and survive. With the potential to automate up to 70% of an underwriter’s tasks, the efficiency gap between early adopters and laggards is rapidly widening.

- Transformative Use Cases: Generative AI is already revolutionizing core insurance functions. From intelligent claims processing and advanced fraud detection to hyper-personalized customer service and dynamic risk assessment, the technology is unlocking new levels of productivity and value across the entire organization.

- The Adoption Dilemma: Despite the clear potential, a sense of caution pervades the industry. Nearly half of insurance professionals express significant concerns about the risks and challenges of implementation, creating a critical divide between those who see opportunity and those who see peril.

- Strategic Implementation is Key: The path to realizing GenAI’s value lies not in blind adoption, but in a strategic, phased approach. Overcoming legacy system barriers, ensuring data privacy, and managing regulatory compliance are the central challenges that successful insurers must navigate.

What if the biggest risk in generative AI isn’t the technology itself, but that your competitors understand its real-world application better than you do?

While nearly half of insurance executives are paralyzed by concerns over risk and complexity, a quiet majority are already deploying GenAI to unlock massive efficiency gains, slashing administrative costs by up to 25% and fundamentally reshaping their competitive landscape.

They’ve discovered something the laggards haven’t: the secret isn’t just adopting AI, but knowing precisely where and how to apply it for maximum impact.

The gap between the hesitant and the decisive is about knowledge.

What are these high-impact use cases that deliver immediate ROI?

How are leaders navigating the very real challenges of data security and legacy systems that hold others back?

This is a look behind the curtain. We will close that knowledge gap, revealing the proven strategies and concrete use cases that separate the winners from the watchers in the new era of insurance.

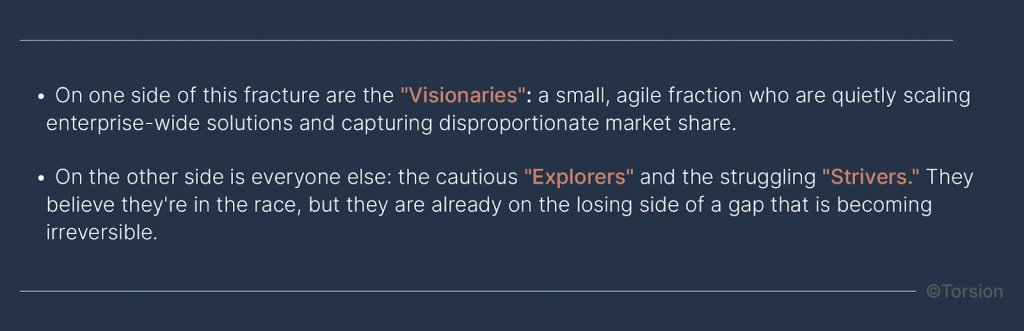

The Invisible Fracture: Why 85% Adoption is the Most Misleading Stat in Insurance

The financial headlines are painting a clear picture: the generative AI market in insurance is set to explode to an astonishing $14.3 billion by 2033. This, combined with reports that up to 85% of insurers are now “exploring or implementing” AI, suggests an industry moving in lockstep towards a tech-forward future.

But what if that picture is dangerously wrong? What if that 85% statistic isn’t a sign of collective progress, but a smokescreen for a deep, invisible fracture that is cleaving the industry in two?

So, what is the secret the Visionaries have unlocked? Why have 77% of top executives suddenly declared that rapid adoption is no longer a choice, but a matter of immediate survival?

It’s because they understand a fundamental truth that the rest are missing. The race is about a specific, counterintuitive strategy for achieving scale and momentum. This strategy is the key that determines who will lead the next decade of insurance, and who will become a footnote.

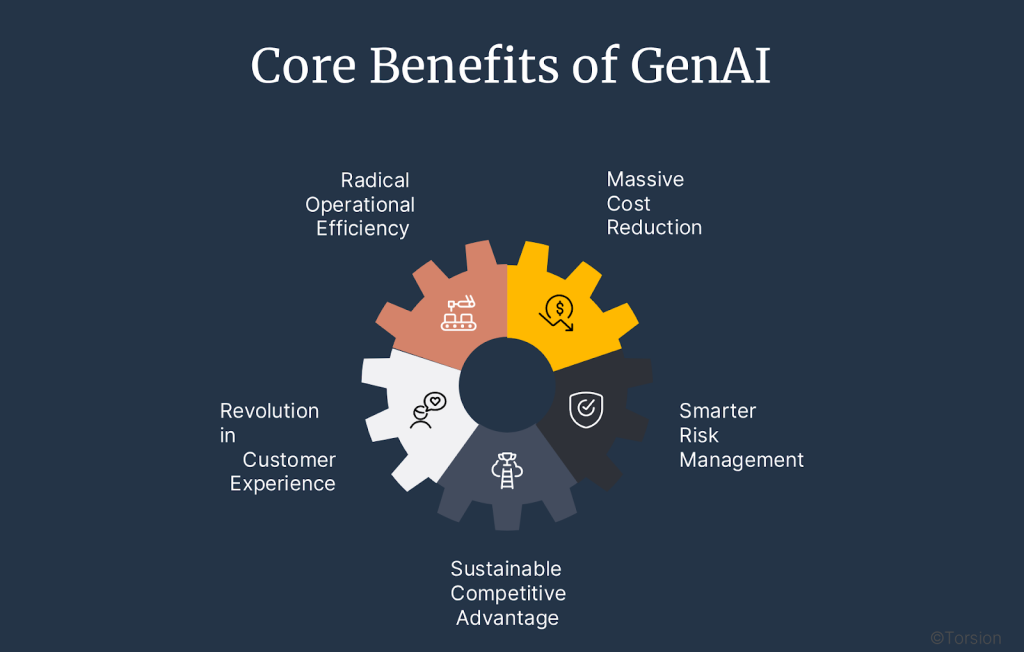

The Engine of Transformation: Unpacking the Core Benefits of GenAI in Insurance

So, what is the powerful secret that the “Visionaries” have unlocked? It’s not a complex, esoteric formula. It’s a ruthless focus on five core, compounding benefits that generative AI is delivering right now.

While others debate the risks, the leaders are executing, turning these theoretical advantages into measurable ROI and widening the competitive divide.

- Radical Operational Efficiency: The most immediate impact of GenAI is its ability to obliterate operational friction. Routine, manual tasks that have bogged down insurance workflows for decades are being automated at an unprecedented scale. We’re seeing productivity gains of 10–20% across entire departments. In underwriting, where data extraction and analysis are paramount, GenAI can accelerate processes by as much as 40%, freeing up expert underwriters to focus on complex, high-value risk assessment rather than paperwork.

- Massive Cost Reduction: This efficiency directly translates into dramatic cost savings. For a large insurer with $10 billion in revenue, the strategic implementation of GenAI can unlock an estimated $150 to $300 million in annual savings. These savings are found across the board, from a 13–25% reduction in administrative overhead to a 5–11% decrease in medical cost ratios through optimized claims management. This isn’t just trimming budgets; it’s reallocating capital from low-value tasks to high-growth innovation.

- A Revolution in Customer Experience: For years, the insurance industry has struggled with a reputation for slow, impersonal service. Generative AI is changing that narrative. By powering intelligent chatbots and personalized communication, leading insurers are achieving a 14% higher customer retention rate and a staggering 48% improvement in Net Promoter Scores (NPS). Policyholders now receive instant answers, tailored advice, and a level of responsiveness that was previously unimaginable, forging loyalty in a traditionally low-trust industry.

- Smarter Risk Management: Generative AI provides a new lens for viewing risk. By synthesizing vast amounts of structured and unstructured data, from claims histories to weather patterns, it can identify fraudulent patterns and assess risks with a level of accuracy that far surpasses human capability alone. This allows insurers to prevent losses and price policies more accurately, creating a more stable and profitable portfolio.

- Sustainable Competitive Advantage: When combined, these benefits create a powerful, sustainable competitive advantage. Firms that leverage GenAI can bring products to market faster, operate with a leaner cost structure, understand risk more deeply, and build stronger customer relationships. It creates a virtuous cycle where efficiency gains fund further innovation, leaving slow-moving competitors caught in a spiral of rising costs and declining market share.

Where the Rubber Meets the Road: High-Impact Use Cases Driving Real ROI

Understanding the benefits of generative AI is one thing; knowing precisely where to deploy it for maximum impact is what separates the leaders from the laggards.

The “Visionaries” aren’t spreading their efforts thin. They are targeting a few key, high-value domains where GenAI can fundamentally re-engineer legacy processes and deliver immediate, measurable returns.

1. Claims Processing & Management: From Bottleneck to Superhighway

For decades, claims processing has been a slow, paper-intensive bottleneck, frustrating customers and draining resources. Generative AI is dismantling this entire structure.

- Automated Document Intelligence: Instead of armies of adjusters manually sifting through unstructured documents like First Notice of Loss (FNOL) reports, medical records, and repair estimates, GenAI now does the heavy lifting. It can instantly extract, classify, and summarize key information with superhuman accuracy, reducing manual data entry by up to 80%.

- Intelligent Triage and Routing: Once the data is extracted, advanced AI models automatically triage claims, routing simple, low-risk claims for straight-through processing while flagging complex or high-risk cases for expert human review. This ensures that skilled adjusters focus their time where it matters most, dramatically speeding up settlement times.

- Proactive Fraud Detection: GenAI can analyze patterns across thousands of claims in real-time, identifying subtle and emerging fraud schemes that would be invisible to human auditors. By flagging suspicious activities at the outset, insurers can prevent losses before they occur, rather than trying to recover them after the fact.

2. Underwriting & Risk Assessment: The End of Guesswork

Underwriting has always been a blend of art and science. Generative AI is amplifying the science to unprecedented levels of precision, allowing underwriters to become true risk strategists.

- Accelerated Submission Analysis: GenAI can ingest and analyze complex submission packages in minutes, not days. It extracts critical data points from broker emails, applications, and attached reports, presenting a clean, summarized risk profile to the underwriter. This allows underwriters to quote more business, faster.

- Enhanced Risk Profiling: By synthesizing vast troves of alternative data from satellite imagery for property insurance to social media sentiment for liability risk, GenAI builds a far more comprehensive and accurate picture of risk. This enables more precise pricing and helps avoid costly miscalculations.

- Dynamic Policy Personalization: With a deeper understanding of individual risk, insurers can move beyond static pricing models. GenAI allows for the creation of dynamic, personalized policies and premiums that more accurately reflect the true risk of each customer, improving both profitability and customer satisfaction.

3. Customer Service & Support: Proactive, Personalized, and Always On

The era of long hold times and generic email responses is over. Generative AI is enabling a new standard of customer experience that builds loyalty and retention.

- 24/7 Intelligent Virtual Assistants: AI-powered chatbots, now supercharged by generative AI, can handle a vast range of customer inquiries with stunning accuracy and a natural, conversational tone. They can answer complex policy questions, guide users through the claims process, and even provide personalized recommendations all without human intervention.

- Hyper-Personalized Communications: Generative AI can draft tailored emails, policy updates, and even renewal notices that speak directly to each customer’s unique situation and history. This replaces generic mass communication with a sense of individual attention, making customers feel valued and understood.

These are the proven, high-impact applications being deployed by the most forward-thinking insurers today. They are the engine of the transformation, converting the potential of GenAI into the hard reality of market leadership.

From Theory to Triumph: Real-World Success Stories

The transformative power of generative AI is not a hypothetical concept; it’s a documented reality being written in the quarterly reports and operational metrics of the industry’s most innovative firms. While skeptics hesitate, leaders are executing, and their success stories provide a clear blueprint for what is possible.

Allstate: Engineering Empathy at Scale

In perhaps one of the most surprising twists of the AI revolution, Allstate discovered that its generative AI models could communicate with customers more empathetically than its human agents. The insurer now uses technology from OpenAI to generate nearly all of its claims-related emails, transforming what were often jargon-filled, frustrating interactions into clear, compassionate, and personalized messages.

The results are staggering. By implementing this AI-driven, human-reviewed workflow, Allstate has:

- Reduced email drafting time by 70%, freeing up agents to handle more complex cases.

- Decreased average call duration as customers receive clearer information upfront.

- Cut complaints about confusing jargon by 30%, leading to higher customer satisfaction and improved Net Promoter Scores (NPS).

Allstate’s success proves that efficiency and empathy are not mutually exclusive; with GenAI, they can be mutually reinforcing.

QBE: Revolutionizing Underwriting and Operations

QBE Insurance Group has embarked on an aggressive, multi-pronged AI strategy that is fundamentally reshaping its core operations. A standout success is their Cyber Submissions AI assistant, which has dramatically accelerated the underwriting process for complex cyber policies. The tool has enhanced not only the speed of submission evaluations but also the accuracy and consistency of risk assessments.

To further empower their underwriters, QBE partnered with Federato to deploy a RiskOps platform that creates a “single pane of glass,” unifying disparate data sources into one coherent view. Beyond underwriting, QBE has automated over 40 processes across claims, credit control, and reinsurance, deploying more than 150 bots.

The ambitious automation drive has freed up an estimated 50,000 working hours per year, with one bot clearing payments in a single hour: a task that previously took a human employee three days to complete.

Aviva: Mastering the Art of AI-Powered Claims

UK-based insurer Aviva provides a masterclass in applying AI to the claims domain. By rolling out more than 80 distinct AI models, Aviva has systematically dismantled claims-handling bottlenecks. The company successfully reduced the liability assessment time for complex cases by 23 days and improved the accuracy of routing claims to the correct teams by 30%.

The transformation had a direct and massive financial impact, saving the company over £60 million (approximately $82 million) in its motor claims division in a single year.

These cases are not outliers. They are powerful indicators of a new operational reality, demonstrating that when strategically deployed, generative AI delivers a decisive and measurable competitive edge.

The Three Dragons: Navigating the Real-World Challenges of GenAI Implementation in Insurance

The journey from generative AI potential to profitable reality is treacherous, littered with the ghosts of failed pilot projects and expensive, abandoned platforms.

The “Strivers” and “Explorers” are not failing due to a lack of ambition; they are being thwarted by a set of predictable, formidable challenges. The “Visionaries” succeed not because they avoid these problems, but because they have a strategy to confront and conquer them head-on.

Dragon #1: The Technical Foundation

The most common point of failure is attempting to build a futuristic AI solution on an archaic technical foundation.

- Legacy System Integration: Many insurers operate on core systems that are decades old. Integrating modern GenAI tools into this environment is often described as “changing the engine mid-flight”. These legacy systems create data silos and process bottlenecks that can cripple an AI initiative before it even begins. In fact, over half of insurers take more than five months to implement even a simple rule change due to these rigid systems.

- Data Quality and Fragmentation: Generative AI is voracious for high-quality data. Yet, in many organizations, critical data is fragmented across disconnected systems, inconsistent, or unstructured. With 72% of providers unable to get a full view of patient information due to poor interoperability, it’s clear that AI models fed with incomplete data will only produce incomplete or biased results.

- Security and Privacy: Insurers are custodians of vast amounts of sensitive personal data. It’s no surprise that a staggering 75% of insurance professionals cite data privacy as their primary concern with GenAI. A single breach could not only lead to massive regulatory fines but also shatter customer trust irrevocably.

Dragon #2: The Human Element

Too often, organizations focus entirely on the technology while ignoring the people who must use it. This is a fatal oversight.

- Workforce Adaptation and the Skills Gap: As one IBM study found, 64% of CEOs believe GenAI’s success hinges more on people than on the technology itself. Yet, leadership focus on upskilling employees remains alarmingly low. Without a clear plan for retraining and role transformation, employees will view AI not as a tool, but as a threat, leading to resistance and fear.

- The Risk-Averse Culture: The insurance industry is, by its very nature, built on caution and risk mitigation. This ingrained “risk mindset” can create a powerful institutional bias against the kind of experimentation and rapid iteration that AI success requires.

Dragon #3: The Regulatory and Ethical Maze

Generative AI operates in a rapidly evolving regulatory landscape, creating a maze of compliance and ethical questions.

- Navigating Regulatory Ambiguity: With global regulations still taking shape, a mere 11% of insurance firms feel prepared to comply with current and future GenAI rules. This uncertainty leads to hesitation, as companies fear deploying a solution that may be non-compliant tomorrow.

- The “Black Box” Problem: Many AI models operate as “black boxes,” making it difficult to explain how a specific decision was reached. This lack of transparency is a major issue in a regulated industry where the rationale behind a denied claim or a specific premium must be justifiable to both customers and regulators. Furthermore, with only 40% of insurers having a formal framework for ethical AI, the risk of deploying biased or unfair algorithms is significant.

The Strategic Path Forward

These dragons, while formidable, are not invincible. Visionary firms overcome them not with brute force, but with a smarter strategy:

- Adopt a Phased Approach: Instead of attempting a “big bang” transformation, leaders start with low-risk, high-impact internal use cases to prove value and build momentum. This allows them to learn, adapt, and build trust within the organization before tackling customer-facing applications.

- Prioritize Data Unification: Successful firms treat data as a strategic asset. They invest in unifying fragmented systems and establishing a clean, accessible data foundation before attempting to scale complex AI models.

- Build Governance from Day One: Rather than treating compliance as a final hurdle, leaders integrate ethical and regulatory frameworks into the design process from the very beginning. This proactive stance turns compliance from a barrier into a design principle.

The Next Frontier: Future Market Potential & Emerging Trends

The generative AI journey in insurance is only just beginning. The initial waves of transformation, focused on automating existing processes, are giving way to a new frontier where GenAI will not just improve the industry but fundamentally reinvent it.

For the “Visionaries” who have successfully navigated the initial challenges, the long-term potential is orders of magnitude greater than the efficiency gains seen today.

The market’s explosive growth to $14.3 billion by 2033 is not an endpoint. It’s a milestone on a much longer journey. As the technology matures and adoption costs decrease, we will see GenAI move from the back office to become the core engine of the entire insurance value chain.

The next decade will be defined by several key trends:

- The Rise of Predictive and Parametric Insurance: The future of insurance lies in preventing loss, not just compensating for it. By integrating GenAI with real-time data from IoT devices like telematics in cars or sensors in commercial properties insurers will be able to actively predict and mitigate risk. GenAI will power the growth of parametric insurance, where claims are paid automatically based on predefined data triggers, eliminating the claims process entirely for certain risks.

- Convergence with Other Technologies: Generative AI will not exist in a silo. Its power will be amplified through convergence with other emerging technologies. The combination of AI with blockchain, for instance, could create immutable, transparent smart contracts for insurance policies that execute automatically, further reducing fraud and administrative overhead.

- Hyper-Personalization at Scale: The one-size-fits-all policy will become a relic of the past. Generative AI will enable the creation of truly dynamic, personalized insurance products that adjust in real-time based on an individual’s behavior and evolving risk profile. This will lead to fairer pricing, more relevant coverage, and deeper customer loyalty.

- The Evolution of Regulatory Frameworks: While regulatory uncertainty is currently a challenge, the future will bring greater clarity. As governments and industry bodies establish clear rules for ethical and transparent AI, it will de-risk adoption for mainstream insurers. This will level the playing field but also raise the table stakes, as compliance becomes a standard operational requirement.

The insurance landscape of 2030 will be almost unrecognizable from today’s. It will be faster, smarter, more resilient, and more deeply integrated into the lives of its customers.

The Choice is Now

Generative AI is no longer a speculative technology on the horizon. It is the engine of the insurance industry’s next great transformation.

The “Visionaries” have proven that success is not born from blind adoption but from a disciplined, strategic focus on high-impact use cases, a commitment to overcoming foundational challenges, and a deep investment in the human side of transformation.

The firms that master this delicate balance of technology, people, and governance will define the new standards for efficiency, customer experience, and risk management.

For the insurers still standing on the sidelines, caught between curiosity and caution, the message from the market is brutally clear: the window to act is closing. The competitive divide is a chasm, and it is growing wider by the day.

The future of insurance will belong to the bold, the strategic, and the swift. Thoughtful, decisive action today is the only thing that will determine who leads the industry tomorrow.