Key Takeaways

- Rule-based systems can’t keep up with modern fraud tactics.

- Predictive AI models detect fraud before it escalates.

- Graph analytics exposes hidden provider collusion networks.

- NLP identifies fraud in unstructured clinical notes.

- Real-time scoring systems reduce lag and false positives.

- Governance ensures compliance, transparency, and trust.

- Regional payers need smarter tech, not just bigger budgets.

Healthcare fraud drains more than $7 billion annually from the U.S. system. And while payers continue investing in detection tools, many are still anchored to systems built for yesterday’s problems.

Legacy frameworks flag what they’re told to flag—but fraud no longer plays by those rules. Synthetic IDs, fabricated patient histories, and provider collusion schemes are designed to bypass threshold-based detection entirely.

In high-volume states like Texas and Florida, regional payers are particularly exposed. They’re dealing with fragmented infrastructure, lean teams, and fraud tactics engineered to exploit exactly those vulnerabilities.

The issue isn’t lack of investment. It’s a lack of transformation.

Today’s fraud networks are agile, networked, and fast. To match them, payer systems must move from static detection to predictive, governed Enterprise AI—designed to learn, explain, and intervene in real time.

In this piece, we’ll unpack how that shift happens—what tech matters, why governance is foundational, and how organizations can future-proof fraud detection at both national and regional scale.

The Shape of the Problem: When Fraud Moves Faster Than Detection

Fraud Is Scaling—Faster Than Systems Can Adapt

In 2024 alone, the HHS-OIG flagged over $7 billion in expected fraud recoveries. CMS reported a 5.09% improper payment rate in Medicaid, translating to over $31 billion.

But beyond the national stats, the real issue is systemic: fraud tactics are outpacing the systems meant to stop them.

Where payers once dealt with individual claim-level fraud, they’re now contending with networked fraud structures—synthetic IDs, fabricated histories, and coordinated provider behavior designed to mimic legitimacy and bypass static controls.

For compliance leads, this creates a traceability challenge.

For investigators, it’s a signal-to-noise problem.

For CTOs, it’s a question of whether their infrastructure can evolve—or needs to be replaced.

Regional Payers: High Risk, Limited Coverage

Texas and Florida aren’t just outliers—they’re early indicators.

In Texas, over $26.4M in Medicaid-related recoveries were recorded in FY24, with major gaps still left in network detection and collusion tracking. In Florida, fraud continues to thrive in metro-heavy claim environments where systems lack the relational intelligence to detect coordination.

What’s the common thread?

Regional payers face enterprise-scale threats but operate with limited data, leaner systems, and siloed detection stacks. They’re being targeted specifically because of these limitations.

The fraud problem is no longer national vs. regional. It’s networked vs. unprepared.

Why Static Detection Frameworks Are Breaking Down

Most fraud detection engines in use today were built around predefined thresholds and known-pattern alerts. They were effective when fraud was predictable. It isn’t anymore.

These systems now suffer from:

- Lag time between detection and action

- Unmanageable false positives that burn out investigative teams

- Blind spots for coordinated activity, synthetic identities, and document-level fabrication

What they lack isn’t sophistication—it’s adaptability. They can’t learn from new patterns, update in real time, or explain their decision logic.

And without explainability, they also fall short of CMS traceability mandates, creating regulatory risk, not just operational inefficiency.

The New Playbook: Adaptive, Network-Aware, and Governed

Fraud tactics now resemble adversarial systems, not opportunistic ones.

- Synthetic identities mimic clean claim behavior.

- Deepfaked documentation passes superficial checks.

- Provider collusion appears compliant—until you analyze network behavior over time.

These tactics are built to defeat static detection. Countering them requires systems that:

- Learn in real time

- Detect relational risk

- Understand context across unstructured and structured inputs

- Generate auditable, explainable outputs

This is where predictive Enterprise AI, NLP, and graph analytics aren’t just “nice to have”—they’re foundational.

From Retrospective Detection to Predictive Defense with Enterprise AI

Traditional detection systems were built for fraud patterns that stood still. Today’s fraud doesn’t.

Enterprise AI marks a structural shift—from retrospective alerts based on known risks, to real-time, governed systems that detect novel behaviors before they escalate.

This shift isn’t just about speed or scale. It’s about intelligence that adapts, explains itself, and integrates across the fraud lifecycle.

Predictive Models: Pattern Recognition That Learns and Adapts

Predictive modeling allows payers to identify statistical anomalies in claims, provider behavior, and billing trajectories before they cross a rule-based threshold.

Unlike static rules, predictive systems:

- Continuously evolve through feedback loops

- Surface multi-factor anomalies across time, not just transaction-level irregularities

- Adapt to emerging schemes like synthetic patient records or provider referral rings

For investigators: this means fewer false leads and higher-fidelity alerts.

For compliance: it enables traceable, auditable detection with documented model behavior.

For CTOs: it means models that improve over time, without manual reconfiguration.

NLP: Parsing Clinical Context to Detect Fraud Hidden in Language

As fraudsters inject false justification into medical narratives—prior auths, appeal letters, procedure notes—structured data alone falls short.

NLP models analyze:

- Unstructured clinical notes for semantic consistency

- Authorization documents for justifications that don’t align with procedures billed

- Appeals and pre-cert text for reused language, fabricated necessity, or mirrored templates

Unlike keyword filters, NLP models build contextual understanding, enabling them to distinguish between legitimate nuance and manufactured complexity.

For clinical reviewers: NLP surfaces intent, not just mismatched codes.

For audit teams: it exposes linguistic anomalies missed by static systems.

Graph Analytics: Mapping Collusion as It Happens

Coordinated fraud isn’t random—it’s relational. Graph analytics maps the connections across providers, facilities, patients, and transactions to uncover collusion networks in real time.

What it reveals:

- Shared identifiers across seemingly unrelated providers

- Repeated patterns of claims routing between known collusion partners

- Time-based provider switching designed to skirt detection

Graph models not only flag behavior—they explain structure. That’s key for proving intent and pursuing recovery.

For investigators: graphs reconstruct fraud architecture, not just incidents.

For legal and compliance: graphs generate defensible narratives for prosecution and regulatory reporting.

Real-Time Claims Scoring: From Risk Flag to Workflow Integration

Fraud detection only creates value when it improves decision velocity.

Real-time claims scoring enables:

- Risk prioritization at ingestion, not post-payment

- Immediate flagging of high-risk submissions for human-in-the-loop review

- Triage-ready outputs embedded directly into case management systems

What makes this powerful isn’t just the scoring—it’s that the score is explainable, with features, relationships, and context traceable across systems.

For ops leads: this closes the loop from detection to resolution without siloed handoffs.

Aligning With CMS, HIPAA, and OCR Isn’t Optional

Modern fraud systems must do more than detect—they must comply.

Enterprise AI architectures must be:

- Auditable: with versioning, decision logs, and user-level traceability

- Explainable: meeting CMS demands for clinical justification transparency

- Secure: aligned with HIPAA/OCR rules for PHI handling and model governance

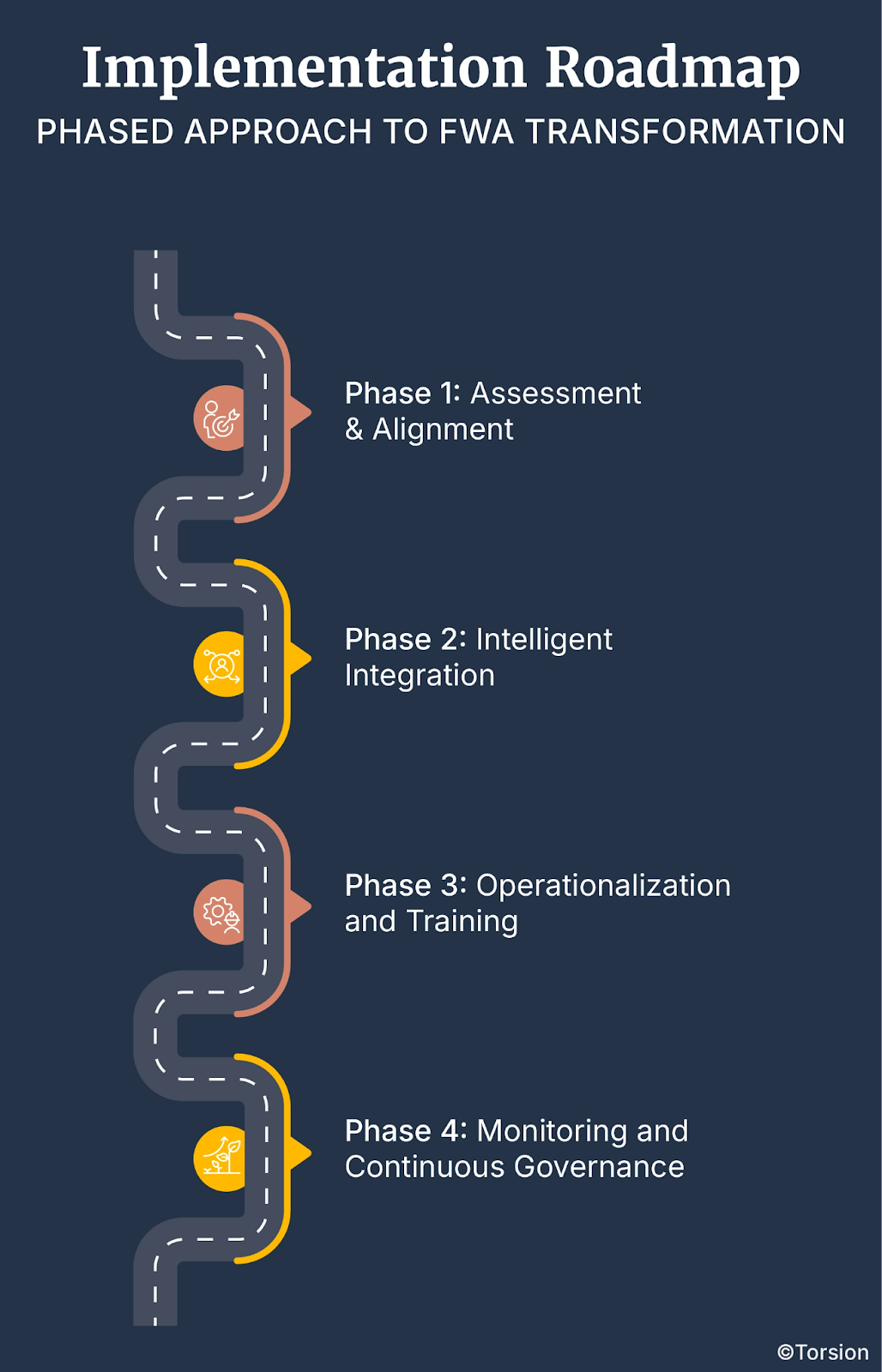

Implementation Roadmap: Phased Approach to FWA Transformation

Deploying Enterprise AI into fraud detection isn’t a tooling upgrade—it’s a system shift. And it won’t succeed unless implementation is governed, phased, and tied to measurable outcomes from day one.

This roadmap reflects what we’ve seen in high-performing payer environments: a stepwise rollout aligned with compliance, operational readiness, and investigative lift.

Phase 1: Assessment & Alignment

Start with clarity—not code. Before implementing any models, organizations need a structured assessment of where their detection, compliance, and data infrastructure fall short.

- Gap Analysis: Are your current systems explainable? Auditable? Traceable? If not, you’re exposed under CMS 2026 requirements.

- Stakeholder Mapping: Identify the people who own risk—compliance leads, audit teams, SIUs, IT, and fraud operations. The Enterprise AI system must serve all of them.

- Regulatory Forecasting: Get ahead of CMS, HIPAA, and OCR shifts now. If you’re designing systems that can’t evolve with policy, you’re hardcoding obsolescence.

Outcome: A clear map of where the friction is—and what “compliant, governed detection” actually looks like in your org.

Phase 2: Intelligent Integration

This is where you embed—not just deploy—Enterprise AI into your fraud lifecycle.

- Deploy Models Where ROI Is Fastest: Target claims types or geographies with known fraud volatility. Start with predictive scoring and graph-based network mapping where alert quality is weakest.

- Integrate NLP into Investigator Workflows: Use NLP to surface inconsistencies in clinical narratives, not just for detection—but for faster resolution.

- Build Governance In, Not Around: Explainability layers, model version control, and PHI protections must be embedded in the deployment stack—not tacked on post hoc.

- Customize to Environment: No two payer orgs are the same. Tailor models to fraud typologies, provider dynamics, and your investigative SOPs.

Outcome: A modular Enterprise AI stack that is high-impact and compliant with systems investigators trust and regulators can audit.

Phase 3: Operationalization and Training

The model works. Now the people need to trust it—and use it.

- Workflow Integration: Embed detection outputs directly into case management tools and dashboards. Alert-to-resolution needs to be seamless.

- Investigator Enablement: Train investigators to understand what the model is flagging and why. Without human-in-the-loop understanding, false positives won’t go down.

- Closed-Loop Feedback: Every resolution should retrain the system. Feedback is fuel. Set up channels where investigators can challenge or correct model outputs—and make that learning stick.

Outcome: A fraud system that gets sharper with every case—and teams that treat AI as a partner, not a black box.

Phase 4: Monitoring and Continuous Governance

Enterprise AI isn’t “set and forget.” It’s live infrastructure. And it needs to be governed like it.

- Real-Time Monitoring: Track concept drift, detection lag, and signal degradation. If you’re not watching the watchers, your system will stale out.

- Audit Readiness: Ensure every flag, model update, and data input is logged. This isn’t just for CMS audits—it’s how you prove integrity.

- Model Governance Reviews: Set a cadence for cross-functional model reviews—across tech, compliance, and investigations. Bias, performance, and explainability must be reviewed with discipline.

- Metrics-Based Refinement: Use fraud-specific KPIs—not just AUC—to drive performance improvements tied to real financial and operational outcomes.

Outcome: An intelligence system that scales with policy, evolves with fraud tactics, and stays transparent by design.

ML-Powered Fraud Detection as an Operational Advantage

Traditional fraud systems flag what’s known. ML-powered systems flag what’s next.

Enterprise AI driven by machine learning isn’t just a model swap—it’s an operational transformation. These systems ingest feedback, adapt to new tactics, reduce alert noise, and surface high-risk behavior in real time.

But beyond detection, ML systems deliver where it counts: speed, precision, auditability, and scale.

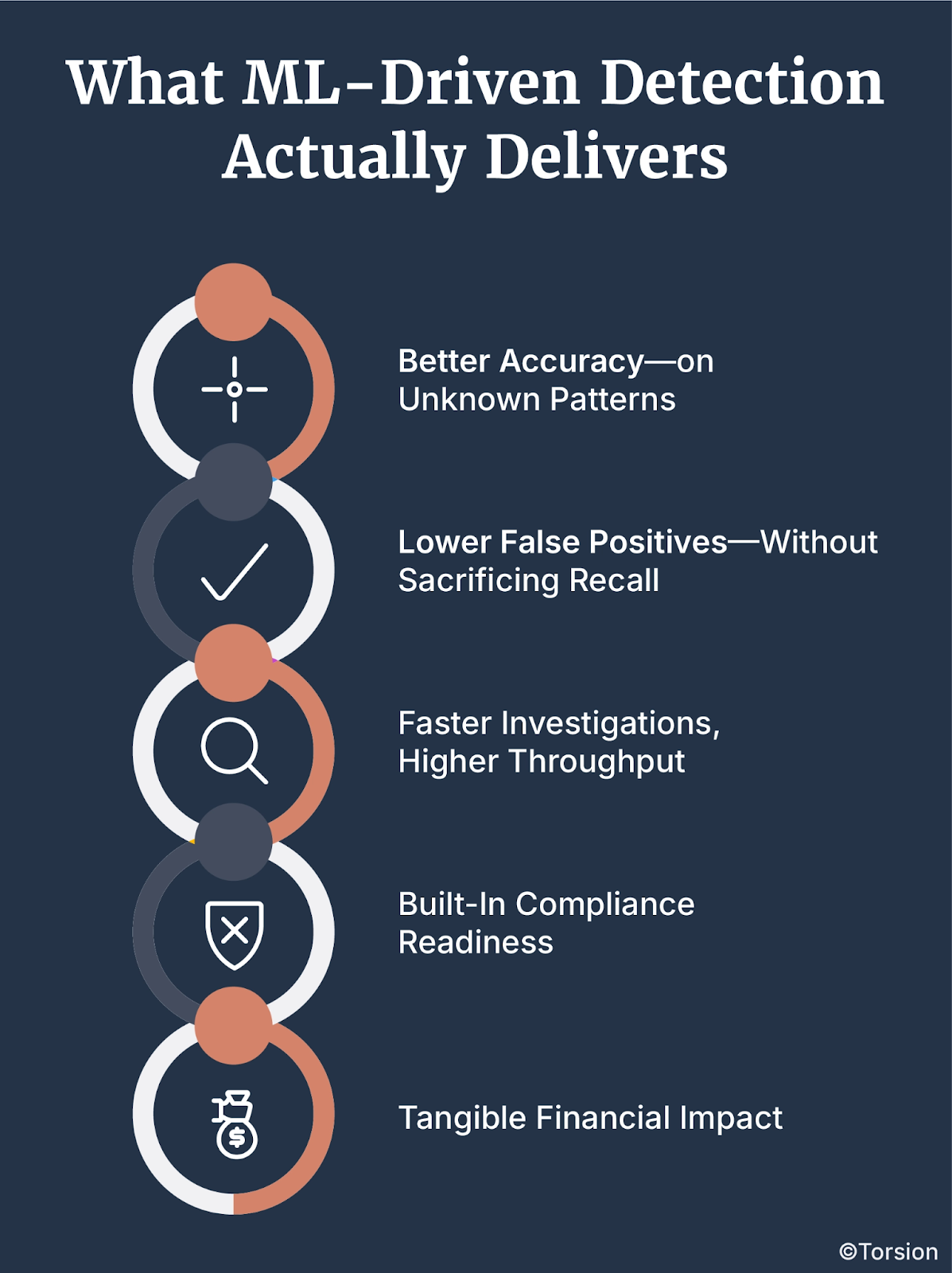

What ML-Driven Detection Actually Delivers

1. Better Accuracy—on Unknown Patterns

ML models outperform rules because they don’t just look for specific fraud types—they detect behaviors that statistically deviate from the norm, even if that behavior hasn’t been seen before.

Payers deploying ML have reported 30–35% increases in fraud detection accuracy—especially in identifying synthetic IDs and emerging network behaviors.

2. Lower False Positives—Without Sacrificing Recall

ML systems differentiate between rare fraud and benign outliers. They improve over time, learning from investigator decisions to reduce noise while maintaining detection coverage.

Regional payers could reduce false positives by 70% within nine months of implementation—without missing real fraud signals.

3. Faster Investigations, Higher Throughput

By triaging alerts with precision, ML frees up investigators to focus on meaningful cases—not endless manual reviews. This speeds resolution cycles and reduces fatigue.

Integrated ML workflows have cut time-to-close by over 60%, while boosting closure rates.

4. Built-In Compliance Readiness

Modern ML systems aren’t black boxes. With governance built in—through explanation layers, audit logs, and access controls—they meet HIPAA, CMS, and OCR standards while staying adaptive.

Organizations using governed ML frameworks report 40% higher audit readiness and fewer compliance exceptions.

5. Tangible Financial Impact

ML is not just a cost center reducer—it’s a revenue protection engine. It prevents fraud before it pays out and recovers it faster when it does.

Across deployments, payers have seen:

- 3x lift in analyst productivity

- Up to 30% more fraud recovered

- Significant downstream savings in litigation, admin, and appeals

Why This Isn’t Just a Technical Upgrade

For CTOs, this means systems that evolve without re-architecture.

For investigators, it’s smarter signal, less noise.

For compliance officers, it’s defensible AI that doesn’t put the organization at risk.

ML-powered fraud systems aren’t future-state—they’re table stakes for any payer looking to move from detection to prevention.

Why Regional Payers Fall Behind—and How to Fix It

Healthcare fraud is a universal problem, but not all payers are equally prepared to tackle it. Regional payers, particularly those operating in states like Texas and Florida, face unique challenges that place them at a strategic disadvantage compared to larger, national players.

The reasons are both structural and operational. Smaller budgets, limited access to cutting-edge technologies, and a lack of comprehensive training programs all contribute to a fragmented approach to fraud detection.

These constraints are compounded by an ever-evolving regulatory landscape that regional payers often struggle to keep up with.

But the biggest issue? Fragmented data.

National payers have the luxury of large datasets that enable robust training of predictive models. Regional payers, however, often work with narrower, less diverse datasets, making it difficult to train models that can detect sophisticated fraud schemes.

Understanding the Gaps

Regional payers aren’t failing to invest in fraud detection. They’re failing to scale. The technological and operational deficits are symptoms of deeper, structural issues that can’t be fixed by simply pouring money into the latest tools.

Resource Constraints

Operating on tighter budgets with smaller fraud detection teams, regional payers often lack the capacity to deploy comprehensive Enterprise AI systems. Limited resources mean prioritizing immediate concerns over long-term innovation. It’s a classic case of being stuck in survival mode.

Regulatory Pressure

Compliance isn’t static. With CMS implementing updates to compliance requirements, especially those anticipated between 2026 and 2027, regional payers must continually adapt their processes to stay compliant.

The problem is, most of them are reacting to regulations rather than proactively preparing for them.

Unlike national payers with dedicated compliance teams, regional entities often rely on outdated frameworks that weren’t designed to handle new requirements for explainability, auditability, and clinical justification transparency.

Evolving Fraud Tactics

Fraudsters are constantly refining their schemes. From synthetic identities and deepfaked patient histories to coordinated provider collusion, these tactics are designed to bypass static, rule-based systems.

Regional payers are disproportionately affected because their systems aren’t built to detect evolving fraud patterns. What’s worse, they often rely heavily on vendor-driven solutions that lack transparency and adaptability.

Strategic Solutions for Regional Payers

Overcoming these challenges requires a combination of technological investment, collaboration, and proactive compliance management. It’s about shifting from survival mode to strategic growth.

Collaborative Data Sharing

Regional payers often work with isolated datasets, which makes it difficult to detect complex fraud schemes. Joining regional consortiums allows these payers to pool data and share insights, enhancing their ability to detect fraudulent patterns that may not be evident within a single organization’s data.

By participating in data-sharing networks, payers can improve their predictive models’ accuracy, particularly when dealing with cross-network fraud schemes. This collaborative approach also helps ensure alignment with CMS’s evolving requirements.

Leveraging Emerging Technologies

Investing in predictive models, NLP systems, graph analytics, and real-time scoring engines can significantly enhance fraud detection capabilities. However, regional payers need to be strategic about their investments.

The key is to implement systems that learn and adapt, rather than relying on static frameworks that simply generate alerts. This includes utilizing Machine Learning (ML) algorithms capable of analyzing claims data to detect anomalies in coding practices and reimbursement patterns.

Additionally, using graph analytics to uncover networks of collusion can significantly enhance detection accuracy, especially when multiple providers are involved in coordinated schemes.

Enhanced Training Programs

Technology alone isn’t enough. To truly enhance fraud detection capabilities, regional payers must invest in training programs that keep investigators and compliance officers up to date with the latest fraud detection techniques and regulatory requirements.

Building feedback loops into these training programs ensures that Enterprise AI systems are continually refined based on real-world feedback. As fraud tactics evolve, so too must the methodologies used to detect them.

Enterprise AI Governance Is the Real Battleground

Healthcare fraud detection isn’t failing due to insufficient technology. It’s failing due to weak governance.

Systems designed to detect fraud are built to react, not predict. They aren’t structured to learn, adapt, or explain their decisions. As a result, they lag behind both evolving fraud tactics and stricter compliance standards from CMS, HIPAA, and OCR.

For regional payers, the challenges are even sharper. Limited budgets, smaller datasets, and reliance on vendor-driven solutions without transparency or adaptability leave them vulnerable. The problem isn’t just technological. It’s structural.

Reactive systems can’t survive in a predictive landscape. What’s needed is an Enterprise AI governance framework that ensures compliance, integrates seamlessly with investigative workflows, and continuously learns from evolving threats.

Know more at https://torsion.ai/contact-us/