Key Takeaways

- With legacy payment costs escalating 57% to $72B by 2028, “keep the lights on” becomes more expensive every year

- Stablecoin integration reduces transaction costs 50%+ (2.5% → 0.5-1%) with real-time settlement vs. 2-3 day delays

- ROI payback: 6-12 months for payment volumes >$50M annually implementation cost recovered in weeks of operation

- Hybrid implementation de-risks modernization, add blockchain alongside legacy, shift volume incrementally, maintain operational continuity

- Partner approach delivers in 2-4 weeks vs. 12-18 months building in-house ($2.5M-$5M vs. $8M-$10M 5-year TCO)

- Decision matrix: Payment volume, international operations, margin pressure determine timing. Not all organizations should modernize immediately

- Cost of waiting: $205K+ per quarter in foregone savings for $100M payment volume organization

The budget review was going well until the CFO asked: “We’re spending $2.3 million on payment infrastructure this year. What are we getting for that money?”

The CTO’s answer: “Transaction processing, PCI compliance, and… keeping the lights on.”

“And next year?”

“$2.6 million. Legacy costs are escalating.”

“For the same functionality?”

“Yes.”

This conversation is happening in boardrooms across every industry. Financial institutions alone will spend $72 billion on legacy payment technology by 2028, up 57% from $46 billion in 2022. That’s not innovation investment. That’s maintenance on systems actively resisting change.

The paradox: 90% of consumers use digital payments, yet over 70% of banks struggle to adapt to regulatory changes because legacy infrastructure can’t keep pace. McKinsey reports over two-thirds of digital transformation initiatives fall short. Gartner estimates one hour of payment system downtime costs $300,000.

Here’s the uncomfortable math: You’re paying more every year for systems that do less. Transaction fees: 2-3% per payment. Settlement delays: 2-3 days. PCI compliance: $250,000+ annually. International transfers: $20-50 per wire with 3-5 day delays.

Meanwhile, stablecoin payment rails operate at 0.5-1% transaction costs with settlement in minutes. The technology exists. The regulatory framework is established (GENIUS Act, MiCA). The question isn’t “Can we modernize?”

The question is: “What’s the cost of waiting another quarter?”

This is the ROI framework every CTO needs to answer that question, and get board approval.

The True Cost of “Keep the Lights On”

Before calculating stablecoin integration ROI, understand what you’re actually spending on legacy payment infrastructure. The number on your budget line is misleading.

Direct Costs (What Shows on the Balance Sheet)

Transaction Fees:

- Credit cards: 2-3% per transaction

- ACH: $0.20-$1.50 per transaction

- Wire transfers: $20-50 per international transfer

- For $100M annual payment volume: $2M-$3M in transaction fees alone

PCI DSS Compliance:

- Level 1 merchants (>6M transactions/year): $550K-$1M implementation + $250K annual maintenance

- Quarterly vulnerability scans: $24,000 annually

- Annual QSA audits: $75,000

- Total: $1M+ implementation, $350K+ annually

Settlement Delays:

- Funds tied up 2-3 days in traditional payment processing

- For $10M monthly volume: ~$700K in working capital locked up at any time

- Opportunity cost: $35K-$70K annually (at 5-10% cost of capital)

System Maintenance:

- Legacy system upkeep escalating 57% by 2028

- One hour downtime: $300,000 average cost

- Industry spending: $72 billion by 2028 (up from $46B in 2022)

Hidden Costs (What Doesn’t Show Up)

Opportunity Cost:

- Delayed time-to-market for new payment features: Legacy systems require 6-12 months for integration changes

- Competitors with modern stacks launch in weeks

- Revenue impact: 5-10% market share erosion to faster-moving competitors

Talent Burden:

- Engineering time maintaining legacy instead of innovating: 40-60% of developer capacity on maintenance

- Recruiting challenge: Top engineers don’t want to work on COBOL-era payment systems

- Opportunity cost: What could your team build with that 40-60% capacity?

Integration Friction:

- New systems bolt onto old infrastructure, technical debt compounds: Every new integration more expensive than the last

- API limitations force workarounds and middleware proliferation

- Cascading failures: One legacy system issue impacts entire payment stack

Regulatory Adaptation:

- 70% struggle with compliance changes due to inflexible legacy systems

- ISO 20022 migration: Manual, expensive, error-prone with legacy infrastructure

- PCI DSS updates require system-wide changes, not configuration

Legacy payment infrastructure isn’t just expensive to maintain. It’s expensive to exist around. Every new feature, every compliance update, every integration becomes progressively harder and more expensive.

The “Do Nothing” Path: A 5-Year Projection

Mid-sized e-commerce example ($100M annual payment volume):

| Year | Transaction Fees | PCI Compliance | Opportunity Cost | Total Annual | Cumulative |

| 2025 | $2.5M | $350K | $500K | $3.35M | $3.35M |

| 2026 | $2.6M (4% growth) | $370K | $600K | $3.57M | $6.92M |

| 2027 | $2.7M | $390K | $700K | $3.79M | $10.71M |

| 2028 | $2.8M | $410K | $850K | $4.06M | $14.77M |

| 2029 | $2.9M | $430K | $1M | $4.33M | $19.10M |

5-year legacy infrastructure cost: $19.1 million

And that assumes no major system failures, regulatory fines, or competitive losses from feature delays.

The Stablecoin Alternative: What Modern Payment Infrastructure Actually Delivers

Stablecoin payment rails aren’t incremental improvements. They’re architectural alternatives with fundamentally different cost structures.

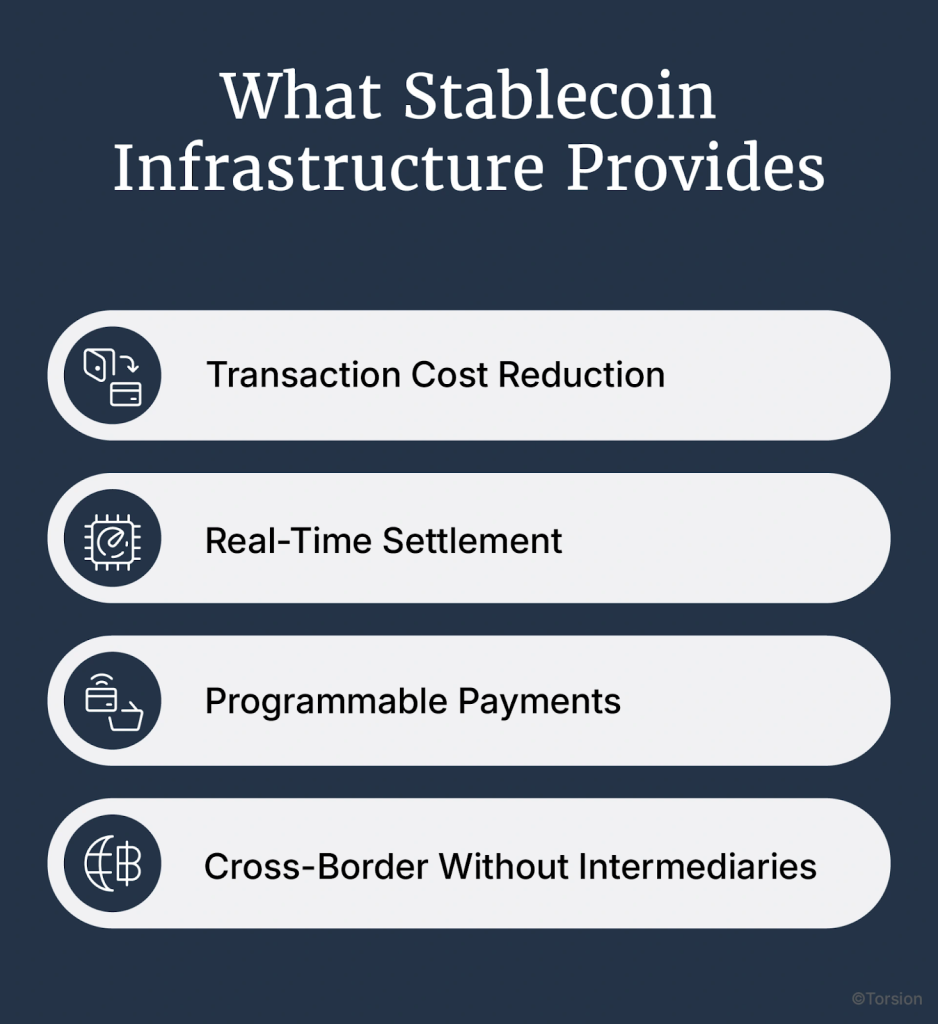

What Stablecoin Infrastructure Provides

Transaction Cost Reduction:

- 0.5-1% processing fees (vs. 2-3% credit cards)

- Network fees: <$1 per transaction (most L2 blockchains)

- For $100M volume: $500K-$1M annually vs. $2M-$3M legacy = $1M-$2M savings

Real-Time Settlement:

- Minutes vs. 2-3 days for funds availability

- Working capital impact: $700K freed up instantly (for $10M monthly volume)

- No chargeback fraud (payment final once blockchain-confirmed)

Programmable Payments:

- Smart contracts enable automated workflows: Escrow, conditional payments, multi-party settlements

- Reduces manual payment operations overhead by 30-50%

- Audit trail immutable and permanently verifiable

Cross-Border Without Intermediaries:

- No correspondent banking delays or fees: Direct peer-to-peer settlement

- International payments: <$5 vs. $20-50 traditional wires

- Settlement: Minutes vs. 3-5 days

When Stablecoins Make Strategic Sense (The Decision Matrix)

Not every organization should modernize immediately. Here’s the framework:

| Factor | Maintain Legacy | Modernize with Stablecoins |

| Annual payment volume | <$10M | >$50M |

| International transactions | <10% of volume | >30% of volume |

| Real-time settlement needed | No (B2C retail) | Yes (B2B, treasury operations) |

| Payment processor geographic limits | None | Blocks key markets |

| Transaction fee margin pressure | Low | High (>2% erodes margin) |

| Technical team capability | None (all outsourced) | Basic REST API integration |

Sweet spot for stablecoin integration:

- High payment volume (>$50M annually)

- International operations (>30% cross-border)

- Real-time settlement critical (treasury, B2B marketplaces)

- Payment processor blocks key markets

- Transaction fee pressure on margins

When to wait:

- Payment volume <$10M (ROI timeline too long)

- Domestic-only, high-margin business

- Recent payment infrastructure overhaul (amortize first)

- No technical team for REST API integration

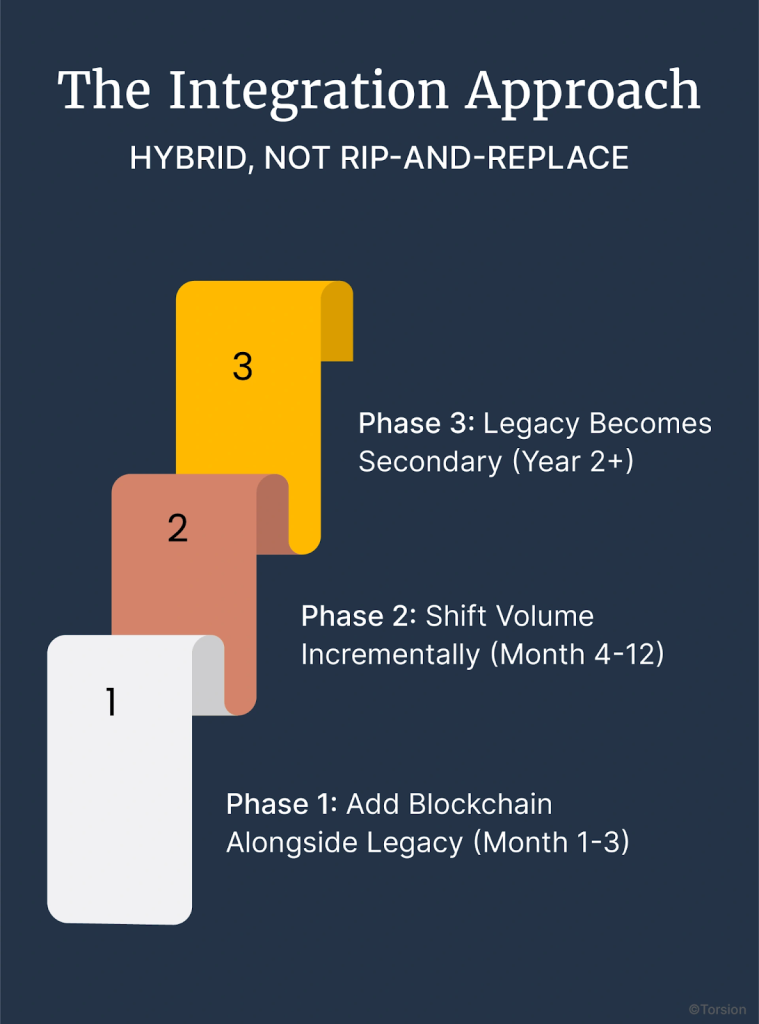

The Integration Approach: Hybrid, Not Rip-and-Replace

This is critical: You don’t abandon legacy payment infrastructure overnight.

Phase 1: Add Blockchain Alongside Legacy (Month 1-3)

- Integrate stablecoin payments as additional checkout option

- Traditional cards, PayPal, Apple Pay remain unchanged

- Start with crypto-native customers or specific use case (international B2B)

- No disruption to existing payment flows

Phase 2: Shift Volume Incrementally (Month 4-12)

- Incentivize stablecoin adoption with 2-5% discount (pass along cost savings)

- Target segments: international customers, high-value B2B transactions

- Measure actual TCO reduction and customer satisfaction

- Goal: 20-30% of payment volume via blockchain

Phase 3: Legacy Becomes Secondary (Year 2+)

- Blockchain becomes primary payment rail for growing customer base

- Traditional payments maintained for mainstream/older demographics

- PCI compliance scope reduces as cardholder data environment shrinks

- Result: 50%+ cost reduction while maintaining operational continuity

The ROI Calculation Every Board Needs to See

CTOs don’t get budget approval with “blockchain is better.” They get approval with payback timelines and NPV calculations.

5-Year TCO Comparison Model

Scenario: Mid-sized e-commerce, $100M annual payment volume

Legacy Payment Infrastructure (Status Quo):

- Transaction fees (2.5%): $2.5M annually

- PCI compliance: $350K annually

- Settlement delays (opportunity cost): $500K annually

- Annual cost: $3.35M

- 5-year total: $19.1M (with 4% annual escalation)

Stablecoin Integration (Torsion):

- Year 1:

- Implementation (2-4 weeks developer time): $50K

- Transaction fees (1% on 20% volume): $200K

- Legacy transaction fees (2.5% on 80% volume): $2M

- PCI compliance (reduced scope): $280K

- Year 1 total: $2.53M (vs. $3.35M legacy = $820K savings)

- Year 2-5:

- Transaction fees (1% on 50% volume): $500K

- Legacy fees (2.5% on 50% volume): $1.25M

- PCI compliance (50% reduced scope): $175K

- Annual: $1.93M (vs. $3.5M+ legacy = $1.6M+ savings)

5-year stablecoin TCO: $10.2M

5-year legacy TCO: $19.1M

Net savings: $8.9M

Payback period: 6-8 months (Year 1 savings exceed implementation cost)

ROI Sensitivity Analysis (What If We’re Wrong?)

CTOs need to model downside scenarios:

Pessimistic Case (30% adoption, not 50%):

- 5-year savings: $5.2M (vs. $8.9M base case)

- Payback: 9-12 months

- Still ROI-positive

Worst Case (Implementation fails, only 10% adoption):

- Lost implementation cost: $50K

- 5-year savings: $1.8M

- Break-even in Year 2, still profitable

Optimistic Case (70% adoption by Year 3):

- 5-year savings: $12.4M

- Payback: 4-6 months

- PCI compliance costs drop 70% as scope shrinks dramatically

The risk-adjusted conclusion: Even pessimistic scenarios deliver positive ROI. The downside is limited ($50K implementation), the upside is substantial ($5M-$12M over 5 years).

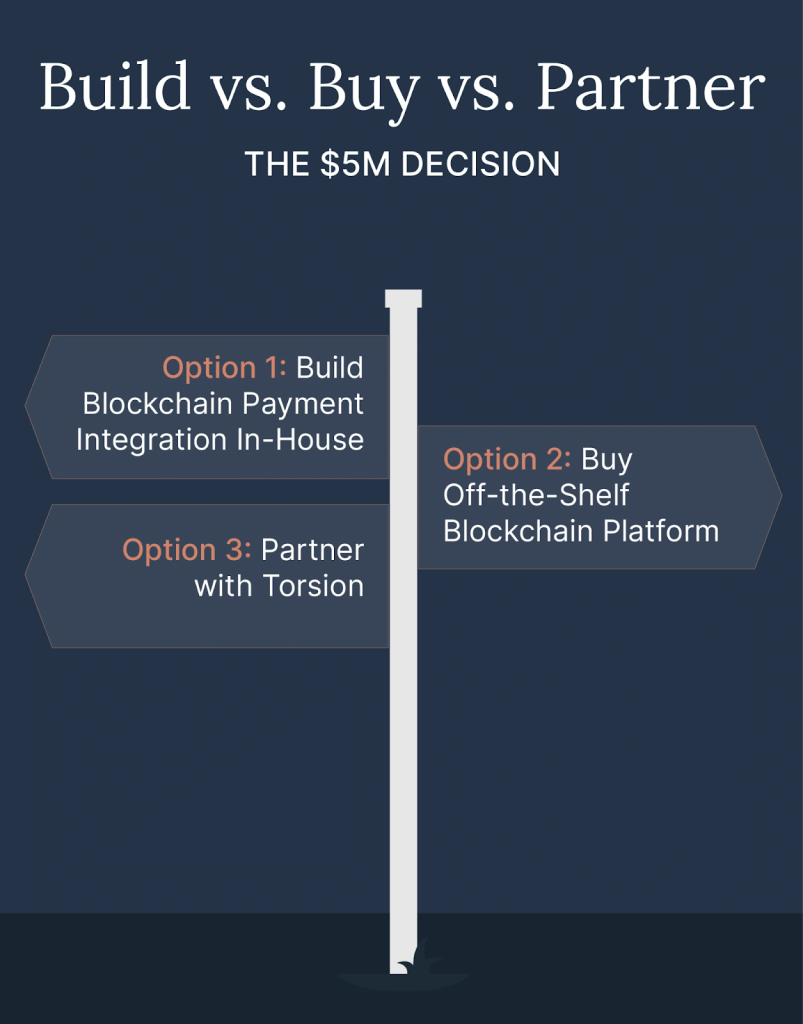

Build vs. Buy vs. Partner: The $5M Decision

Every CTO faces this question. The analysis is stark.

Option 1: Build Blockchain Payment Integration In-House

What it requires:

- Hire blockchain engineers ($150K-$300K salaries, 6+ month recruitment)

- Build node infrastructure, wallet integrations, smart contract layer

- Compliance implementation (GENIUS Act, MiCA frameworks)

- Testing, security audits, ongoing maintenance

Timeline: 12-18 months

Cost:

- Development: $3M-$5M

- Ongoing maintenance: $500K-$1M annually

- Total 5-year: $8M-$10M

Risk: 67% of digital transformation initiatives fail. If you’re in that 67%, you’ve spent $5M with zero ROI.

When this makes sense: Payment infrastructure is your core business (you’re Stripe, not using Stripe).

Option 2: Buy Off-the-Shelf Blockchain Platform

What it requires:

- License enterprise blockchain platform ($500K-$2M)

- Custom integration work (6-12 months)

- Staff training, operational procedures

- Ongoing support and upgrades

Timeline: 6-12 months

Cost:

- Licensing + integration: $2M-$4M

- Annual maintenance: $300K-$500K

- Total 5-year: $3.5M-$6.5M

Risk: Platform may not integrate cleanly with your e-commerce stack. Vendor lock-in. Still requires blockchain expertise in-house.

When this makes sense: Large enterprise with dedicated blockchain strategy team and multi-use-case roadmap.

Option 3: Partner with Torsion

What it provides:

- REST API integration with existing e-commerce platform (Shopify, WooCommerce, Magento)

- Torsion operates blockchain infrastructure (nodes, network connections, gas optimization)

- GENIUS Act + MiCA compliance built-in

- Auto-conversion: Customer pays USDC, merchant receives USD if desired

- Full accounting integration (NetSuite, SAP, QuickBooks, Xero)

Timeline: 2-4 weeks

Cost:

- Implementation: $50K (developer integration time)

- Transaction-based pricing: 0.5-1% of blockchain payment volume

- Total 5-year: $2.5M-$5M (scales with usage)

Risk: Minimal. Hybrid model means legacy remains operational. Can scale back if ROI doesn’t materialize.

When this makes sense: Payments are critical infrastructure but not core differentiator. Want fast time-to-value with de-risked implementation.

The Decision Matrix

| Approach | Timeline | 5-Year Cost | Risk Level | Best For |

| Build In-House | 12-18 months | $8M-$10M | High (67% fail) | Payment processors, core business |

| Buy Platform | 6-12 months | $3.5M-$6.5M | Medium | Large enterprises, multi-use-case |

| Partner (Torsion) | 2-4 weeks | $2.5M-$5M | Low (hybrid model) | E-commerce, SaaS, B2B platforms |

For most CTOs: Partner approach delivers fastest time-to-value, lowest risk, and comparable 5-year TCO to build/buy, without diverting engineering resources from core product development.

The Implementation Roadmap: From Board Approval to Production

This is the deck you take to your next board meeting.

The Business Case

Current State:

- Payment volume: $100M annually

- Transaction costs: $2.5M (2.5%)

- PCI compliance: $350K annually

- Settlement delays: 2-3 days

- Total annual cost: $3.35M

Proposed State:

- Stablecoin integration via Torsion

- Transaction costs: $500K-$1M (0.5-1% on target volume)

- PCI scope reduction: $175K (50% reduction as volume shifts)

- Settlement: Real-time (minutes)

- Projected annual cost: $1.93M

ROI:

- Implementation: $50K, 2-4 weeks

- Year 1 savings: $820K

- 5-year savings: $8.9M

- Payback: 6-8 months

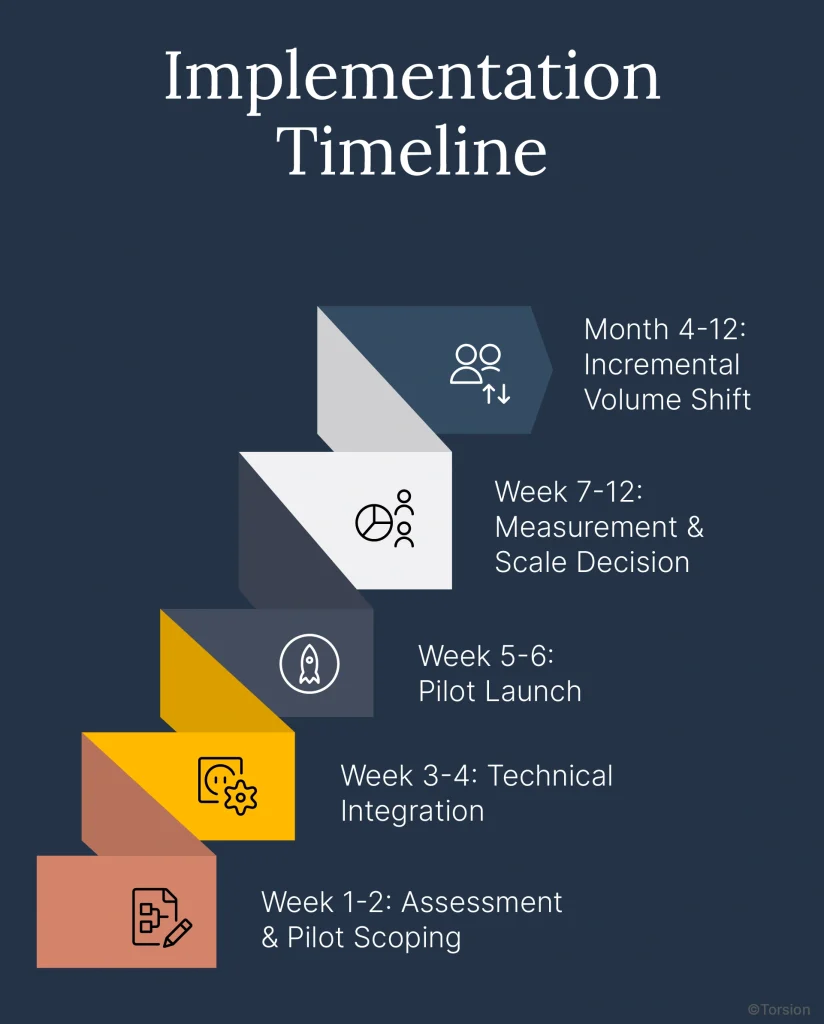

Implementation Timeline

Week 1-2: Assessment & Pilot Scoping

- Identify highest-value use case (international B2B payments, high-fraud verticals)

- Technical architecture review with Torsion

- Define success metrics (cost per transaction, settlement time, customer satisfaction)

Week 3-4: Technical Integration

- REST API integration with payment gateway

- Webhook configuration for transaction status

- Test environment setup and validation

Week 5-6: Pilot Launch

- Deploy to limited customer segment (crypto-native, international)

- Run parallel with traditional payments (hybrid model)

- Daily metrics monitoring

Week 7-12: Measurement & Scale Decision

- Calculate actual TCO vs. projections

- Customer feedback and UX assessment

- Board review: Continue to Phase 2 or pause

Month 4-12: Incremental Volume Shift

- Expand to broader customer base

- Incentivize blockchain adoption with discounts

- Target: 20-30% payment volume via stablecoins

Risk Mitigation

Operational Risk: What if payments fail?

- Mitigation: Hybrid model maintains traditional payment methods

- Blockchain operates alongside, not instead of, legacy

- Customer always has fallback option

Financial Risk: What if ROI doesn’t materialize?

- Mitigation: Transaction-based pricing means costs scale with usage

- No large CapEx commitment

- Can reduce blockchain volume if savings don’t materialize

Technical Risk: What if integration is complex?

- Mitigation: Torsion’s REST API standard integration (like Stripe, Adyen)

- 2-4 week timeline proven across multiple e-commerce platforms

- No blockchain expertise required from internal team

Regulatory Risk: What if framework changes?

- Mitigation: GENIUS Act (U.S.) and MiCA (EU) provide 5+ year regulatory stability

- Torsion infrastructure updates automatically for compliance changes

- Major stablecoin issuers (Circle/USDC, Tether/USDT) committed to compliance

Peer Benchmarks

Industry Adoption:

- 13% of companies already using stablecoins for payments

- 54% plan adoption within 6-12 months (post-GENIUS Act survey)

- Stripe applied for OCC national bank charter to issue stablecoins

- BlackRock supporting stablecoin issuer infrastructure

Competitive Positioning:

- Fintech competitors operate at 1% transaction costs

- Traditional players at 2-3% transaction costs

- Cost structure determines pricing power and margin

Market Trajectory:

- By 2030: $2.1-4.2 trillion in cross-border payments via stablecoins

- Stablecoin market cap: $3+ trillion projected

- Early movers capture market share before saturation

The Ask

Budget Request:

- Implementation budget: $50K

- Authority to pilot stablecoin payments with Torsion

- 90-day pilot with defined success metrics

- Board review at end of pilot for Phase 2 expansion

Success Criteria:

- Cost per transaction <1% (vs. 2.5% legacy)

- Settlement time <1 hour (vs. 2-3 days legacy)

- Customer satisfaction >90% (pilot segment)

- Zero payment failures or security incidents

Decision Point:

- After 90-day pilot, present actual TCO vs. projection

- Board approves Phase 2 expansion or discontinues

- Risk-limited to $50K pilot investment

What Doesn’t Justify Replacement (The Honest Assessment)

Not every organization should modernize payment infrastructure in 2025. Here’s when to wait:

Low Payment Volume

If annual payment volume <$10M:

- Transaction cost savings too small to justify implementation effort

- ROI timeline extends beyond 24 months

- Better use of engineering resources: Focus on core product development

Example calculation:

- $10M volume × 1.5% savings = $150K annual benefit

- Implementation cost: $50K

- Payback: 4-6 months, but absolute savings marginal

Domestic-Only, High-Margin Business

If 90%+ payments are domestic with >30% gross margins:

- Transaction cost pressure minimal (absorbed by margins)

- No cross-border pain points (settlement delays, FX fees)

- Customer base satisfied with traditional payment methods

- Strategic priority: Other initiatives have higher ROI

Recent Payment Infrastructure Overhaul

If you modernized payment systems in last 18-24 months:

- Need to amortize recent CapEx investment

- Legacy infrastructure relatively modern and flexible

- Financial discipline: Let previous investment mature before next modernization

Regulatory Uncertainty in Your Market

If operating in jurisdictions without clear stablecoin framework:

- GENIUS Act (U.S.) and MiCA (EU) provide regulatory clarity

- Other regions still developing frameworks

- Risk mitigation: Wait for local regulatory guidance before implementation

When Customer Adoption Isn’t There

If your customer base is:

- Predominantly older demographics unfamiliar with digital wallets

- Low-tech industries resistant to payment method changes

- UX consideration: Blockchain checkout adds friction for non-technical users

Mitigation: Even if these apply, hybrid model allows selective deployment. Offer blockchain to segments where it makes sense (B2B, international, crypto-aware), maintain traditional for others.

The Decision Framework: Should You Modernize Now?

Use this rubric to assess your organization:

Score Your Payment Infrastructure (0-5 scale for each factor)

Financial Factors:

- Annual payment volume: 0 (<$10M), 3 ($10M-$50M), 5 (>$50M)

- Transaction fee margin pressure: 0 (no pressure), 3 (moderate), 5 (severe)

- Available implementation budget: 0 (<$50K), 3 ($50K-$100K), 5 (>$100K)

Operational Factors:

4. International payment volume: 0 (<10%), 3 (10-30%), 5 (>30%)

5. Real-time settlement importance: 0 (not needed), 3 (helpful), 5 (critical)

6. Payment processor geographic limits: 0 (none), 3 (minor), 5 (blocks key markets)

Technical Factors:

7. In-house development capability: 0 (none), 3 (basic REST API), 5 (advanced)

8. Legacy system flexibility: 0 (rigid), 3 (moderate), 5 (flexible/API-driven)

9. Technical team capacity: 0 (fully allocated), 3 (some bandwidth), 5 (available capacity)

Strategic Factors:

10. Competitive pressure: 0 (none), 3 (moderate), 5 (severe/losing market share)

11. Board modernization mandate: 0 (no priority), 3 (considering), 5 (top priority)

12. Risk tolerance: 0 (extremely low), 3 (moderate), 5 (high for innovation)

Interpretation

Score 40-60: Modernize immediately with Torsion

- High payment volume, significant margin pressure, strategic priority

- ROI payback <12 months, competitive necessity

- Hybrid implementation de-risks transition

- Action: Present board deck this quarter, pilot next quarter

Score 25-39: Pilot in 2025, scale in 2026

- Moderate payment volume, some cost pressure

- ROI payback 12-18 months

- Competitive advantage but not urgent

- Action: 90-day pilot to validate ROI, expand if positive

Score 0-24: Monitor and reassess Q2 2026

- Low payment volume or low margin pressure

- ROI timeline >24 months

- Other strategic priorities higher

- Action: Watch peer adoption, revisit when payment volume grows or competitive pressure increases

The Choice Every CTO Faces

The question isn’t whether legacy payment infrastructure will eventually be replaced. It will. The question is whether you modernize proactively, capturing 5 years of cost savings and competitive advantage, or reactively, after competitors force your hand.

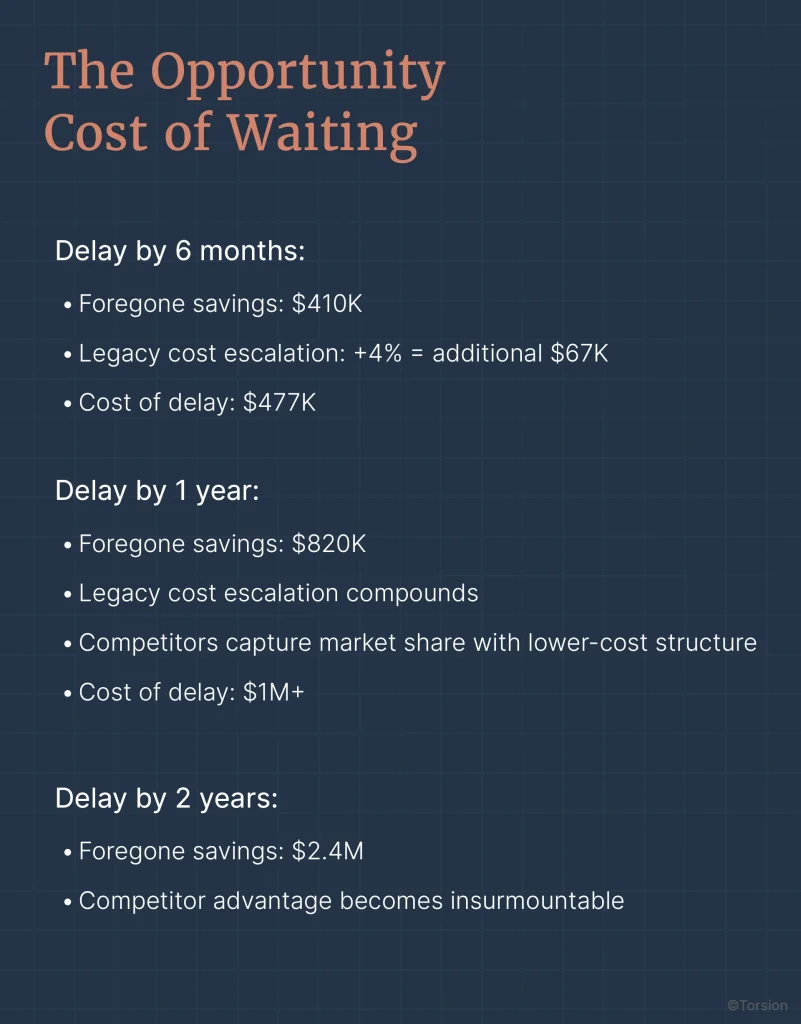

The Cost of Waiting

Delay by 1 quarter:

- Foregone savings: $205K

- Competitive positioning erosion: Unmeasurable but real

- Cost: $200K+

Delay by 1 year:

- Foregone savings: $820K

- Legacy cost escalation compounds

- Competitors capture market share with lower-cost operations

- Cost: $1M+

Delay by 2 years:

- Foregone savings: $2.4M

- Competitor advantage becomes insurmountable

- Board questions why CTO didn’t act when ROI was clear

- Cost: Career risk

Next Steps: From Analysis to Execution

If your organization scored 25+ on the decision framework, here’s your action plan:

This Week:

- Share this ROI analysis with CFO and CEO

- Calculate your specific TCO comparison (use your payment volume, not generic example)

- Identify highest-value pilot use case (international B2B, high-fraud vertical)

This Month:

- Present 5-slide board deck (business case, timeline, risk mitigation, peer benchmarks, budget request)

- Get approval for $50K pilot with Torsion

- Schedule technical assessment with Torsion team

This Quarter:

- Execute 2-4 week REST API integration

- Launch 90-day pilot with defined success metrics

- Measure actual TCO vs. projection

Next Quarter:

- Board review: Pilot results vs. business case

- Approve Phase 2 expansion or adjust approach

- Begin incremental volume shift to blockchain payments

The Torsion Advantage:

Just as Torsion bridges AI strategy to execution for healthcare payers and insurance companies, we apply the same methodology to payment infrastructure modernization: You understand the business case, we handle the technical implementation.

REST API integration with your e-commerce platform. GENIUS Act and MiCA compliance built-in. Blockchain operations managed by Torsion. Your treasury team never touches crypto infrastructure directly. 2-4 weeks from kickoff to production. Transaction-based pricing that scales with usage.

Can you afford to wait another quarter while paying $205,000 in unnecessary transaction fees?