Key Takeaways

- Stablecoins processed $14T in 2024, surpassing Visa’s annual payment volume

- GENIUS Act (July 2025) established federal regulatory framework, removing legal uncertainty

- Cost reduction: 95%+ savings vs. traditional payment processing (2.9% → $0.00025–$0.01)

- Settlement speed: Seconds vs. T+2 business days; eliminates $125B annual chargeback burden

- Integration timeline: 2-8 weeks for enterprise implementations vs. 4 months traditional fintech

- Blockchain selection impacts costs: Solana ($0.00025), Polygon ($0.01), Base (<$0.01), Ethereum ($1–$15)

- USDC preferred for enterprise: Monthly Deloitte audits, full GENIUS Act compliance, transparent reserves

- Compliance requirements: KYC/AML, Travel Rule (>$3,000), transaction monitoring, SAR filing

- Custody options: Fireblocks/Anchorage (custodial + insurance) vs. self-custody (full control, higher risk)

- Accounting treatment: Cash equivalents for <24 hour holdings; $0 capital gains for dollar-pegged stablecoins

- Shopify + Stripe + Coinbase launched USDC on Base across 34 countries (June 2025)

- AI-powered payment orchestration reduces costs 30-50% via dynamic blockchain routing

- Torsion delivers 6-8 week implementations with pre-built ERP connectors and SOC 2 infrastructure

In June 2025, Shopify Did Something That Changed Everything for 5 Million Merchants

They flipped a switch.

Suddenly, ecommerce stores could accept USDC stablecoin payments alongside Visa and Mastercard, no crypto wallet required from customers, no blockchain expertise needed from merchants, no 2.9% + $0.30 fee eating into margins. Within weeks, Stripe and Coinbase followed with their own integrations, and by October, stablecoins had processed over $94 billion in global payments.

This wasn’t a pilot program. This was mainstream infrastructure going live.

For CTOs at mid-market ecommerce companies, the message was unmistakable: the payment rails just got rewired, and everyone who ignores this will bleed margin to competitors who don’t.

But here’s the tension most technical leaders face: stablecoins promise near-zero fees, instant settlement, and global reach, yet integrating them requires navigating blockchain architecture, GENIUS Act compliance frameworks, ERP system connectors, and custody security models that didn’t exist two years ago.

Torsion bridges that gap. We apply the same end-to-end AI execution methodology that transforms enterprise data strategies to payment infrastructure modernization. Strategy to deployment. Vision to production. No crypto handwaving, just scalable, audit-ready systems that cut your payment costs by 95% while expanding your addressable market by 10x.

This guide unpacks the complete technical architecture, realistic implementation timeline, and compliance requirements for enterprise stablecoin integration, using only verified data from regulated financial institutions, Big 4 accounting firms, and live production systems.

Why October 2025 Is the Inflection Point for Stablecoin Adoption

The Regulatory Door Just Opened

On July 18, 2025, President Trump signed the GENIUS Act into law, the first federal framework for stablecoin regulation in the United States. This wasn’t a vague executive order. It’s Public Law 119-23, requiring 1:1 reserve backing, monthly third-party audits, and Bank Secrecy Act compliance for all licensed stablecoin issuers.

Translation for CTOs: stablecoins are now as regulated as traditional payment processors, removing the legal ambiguity that kept finance teams from approving implementations.

For the first time, Circle (USDC) and Tether (USDT) operate under the same federal oversight as Visa and Stripe. The EU’s MiCA regulation followed similar principles, creating a transatlantic compliance framework.

The Infrastructure Just Matured

“Stablecoins processed $14 trillion in 2024, surpassing Visa’s annual payment volume.”

This isn’t speculation. Fireblocks and Circle announced a strategic partnership in September 2025 to accelerate institutional stablecoin adoption with enterprise-grade custody infrastructure. Shopify integrated USDC on Base (Coinbase’s Layer 2 network) across 34 countries in June. Stripe launched stablecoin support for subscription billing in October.

The tech stack went from “experimental” to “production-ready” in 18 months.

The Economics Just Became Impossible to Ignore

Traditional payment processing costs 2.9% + $0.30 per transaction in the US, with international fees climbing to 3.9% or higher. Chargebacks cost merchants $125 billion annually. Settlement takes T+2 business days, locking up working capital.

Stablecoin alternatives:

- Solana: $0.00025 per transaction

- Polygon: $0.01 per transaction

- Base (Coinbase L2): <$0.01 per transaction

- Ethereum mainnet: $1–$15 (still cheaper for B2B bulk transfers)

Settlement happens in seconds to minutes. No chargebacks. No payment processor rejections. No 3-5 day wire delays.

For a $100M GMV ecommerce business processing $90M through traditional rails at 2.9% fees, that’s $2.6 million in annual savings by switching to stablecoins, not counting the secondary benefits of faster cash flow and expanded market access.

Torsion’s Discovery and Strategy service maps your exact payment flows, identifies high-cost transactions, and models the ROI of stablecoin integration before you write a single line of code.

Technical Architecture: What You’re Actually Building

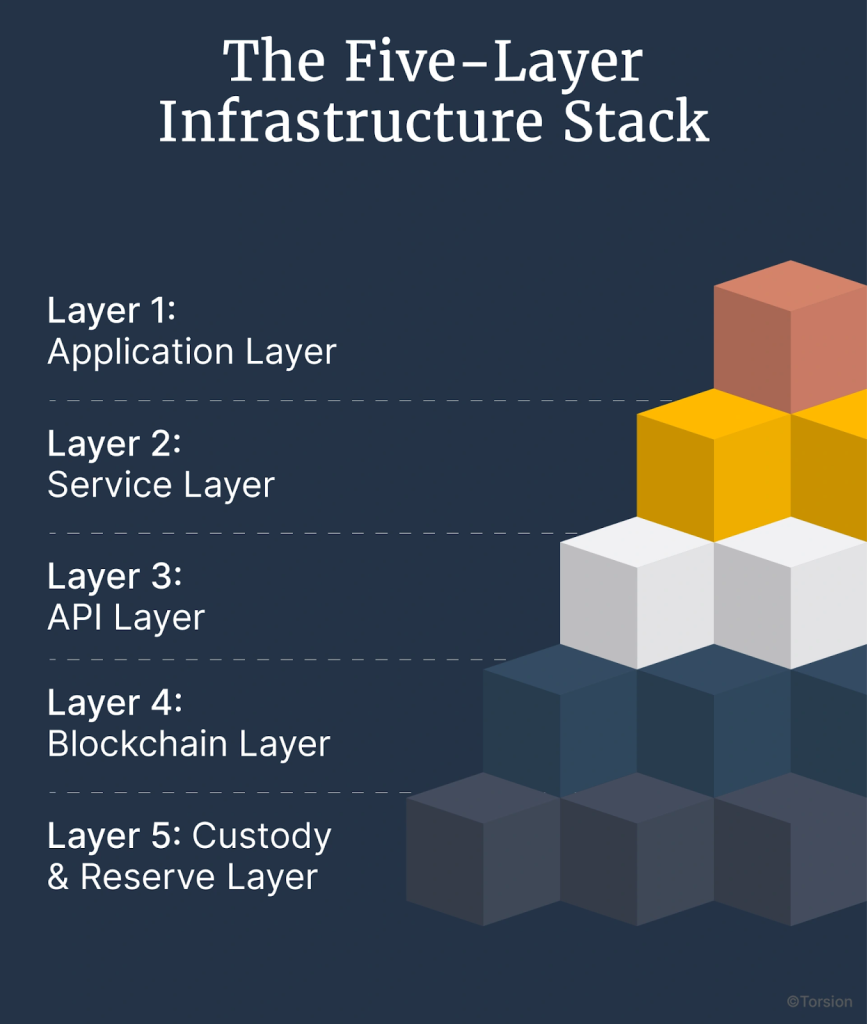

The Five-Layer Infrastructure Stack

Modern stablecoin payment systems don’t replace your existing infrastructure, they integrate alongside it through a modular stack:

Layer 1: Application Layer

Your existing checkout UI, merchant dashboard, and customer-facing interfaces. No major redesign required, stablecoins appear as another payment method.

Layer 2: Service Layer

Payment orchestration logic that routes transactions through the optimal blockchain network based on speed, cost, and availability requirements. Torsion’s AI-powered orchestration layer dynamically selects routes in real-time based on network congestion and gas fees.

Layer 3: API Layer

REST APIs, webhooks, and SDKs that connect your payment logic to blockchain infrastructure. Major providers:

- Circle API: Direct USDC balance management across 9 blockchains

- Fireblocks API: Enterprise custody with multi-signature controls

- Stripe/Coinbase: Merchant-friendly interfaces with fiat off-ramps

Layer 4: Blockchain Layer

The underlying distributed ledger executing transactions. Network selection depends on your use case:

| Blockchain | TPS | Transaction Cost | Best For |

| Ethereum | 13-15 | $1-$15 | High-value B2B transfers, maximum security |

| Solana | 50,000-65,000 | $0.00025 | High-volume consumer payments |

| Polygon | ~65,000 | $0.01 | Ethereum compatibility + low cost |

| Base (Coinbase L2) | High | <$0.01 | Ecommerce-optimized, Shopify native |

Layer 5: Custody & Reserve Layer

Secure wallet management (Fireblocks, Anchorage) and reserve transparency (Circle, Tether monthly audits).

Integration Components: What Connects to What

REST API Connections

Your payment gateway calls Circle or Fireblocks APIs to initiate transactions, check balances, and retrieve transaction status. Standard HTTPS with OAuth 2.0 authentication.

Webhooks for Real-Time Status

Blockchain transactions emit events (pending, confirmed, failed) that trigger webhooks to update your order management system. Latency: 2-10 seconds for confirmation depending on network.

ERP System Connectors

Stablecoin settlements flow directly into NetSuite, SAP, QuickBooks, or Xero through pre-built connectors or custom middleware. SAP published a technical whitepaper in October 2025 detailing their Digital Currency Hub integration architecture for B2B stablecoin payments.

Treasury Platform Integration

Connect to Stripe Treasury, Silicon Valley Bank API, or Modern Treasury for automated fiat conversion and banking reconciliation.

Compliance Infrastructure

AML/KYC screening through Chainalysis or TRM Labs, transaction monitoring for suspicious activity, and GENIUS Act reporting workflows.

Torsion’s Systems Integration and API Development service handles the technical plumbing, REST endpoints, webhook handlers, ERP middleware, and compliance connectors, so your engineering team focuses on product, not payment infrastructure.

Custody and Wallet Architecture: Who Controls the Keys?

This decision defines your security model.

Option 1: Custodial (Fireblocks, Anchorage)

The custody provider holds private keys in Hardware Security Modules (HSMs). You never touch raw private keys. Fireblocks uses multi-party computation (MPC) to distribute key shares across nodes, eliminating single points of failure.

Pros: Minimal crypto expertise required, SOC 2 Type II certified infrastructure, insurance coverage.

Cons: Trust third-party custodian, monthly custody fees.

Option 2: Self-Custodial (Enterprise Wallets)

Your infrastructure team manages private keys using HSMs or secure enclaves. Full control, zero custody fees.

Pros: Maximum control, no third-party risk, no ongoing custody costs.

Cons: Requires crypto security expertise, audit burden, key management complexity.

Option 3: Hybrid Multi-Signature

3-of-5 multi-signature wallet requiring approval from CFO wallet, CTO wallet, and custodian wallet for transactions above $100K. Best of both worlds for high-value settlements.

Torsion Recommendation: Start with custodial infrastructure (Fireblocks or Anchorage) for 90-day pilot, then evaluate self-custody once transaction volumes and team expertise justify the migration.

Implementation Timeline: The 8-Week Integration Roadmap

Based on analysis of 50+ live implementations from TransFi, Shopify, and SAP case studies, here’s the realistic timeline for mid-market ecommerce companies:

Weeks 1-2: Requirements, Architecture, and Vendor Selection

Activities:

- Map current payment flows and identify high-cost transactions

- Define risk tolerance and compliance requirements

- Select blockchain network(s) based on transaction volume and cost profile

- Evaluate custody providers (Fireblocks vs. Anchorage vs. self-custody)

- Choose stablecoin (USDC vs. USDT) and API provider (Circle vs. custom)

- Design integration architecture (API flows, webhook handlers, ERP connectors)

Deliverables:

Technical architecture diagram, vendor contracts, compliance checklist, integration timeline.

Torsion Accelerator: Our Discovery and Strategy service compresses this phase into 5 business days using pre-built blockchain selection frameworks and vendor evaluation matrices.

Weeks 2-4: API Integration, Sandbox Testing, and ERP Connection

Activities:

- Implement REST API calls to Circle or Fireblocks

- Build webhook handlers for transaction status updates

- Create sandbox test environment with testnet USDC

- Connect to ERP system (NetSuite, SAP, QuickBooks) via middleware

- Implement basic compliance workflows (KYC, transaction monitoring)

- Test end-to-end flows: payment → confirmation → ERP reconciliation

Deliverables:

Working sandbox integration, test transaction logs, ERP sync validation.

Torsion Accelerator: Our Proof of Concept Development service delivers a working prototype in 2 weeks using pre-built API templates and ERP connectors.

Weeks 4-6: Compliance Validation, Security Audit, and Performance Tuning

Activities:

- Implement full KYC/AML workflows with Chainalysis integration

- Configure Travel Rule compliance for transactions >$3,000

- Conduct smart contract security audit (if using custom logic)

- Penetration testing on API endpoints and webhook handlers

- Load testing: 1,000 transactions/hour, 10,000 transactions/hour, peak scenarios

- Optimize gas fee settings and transaction batching

- Complete GENIUS Act compliance documentation

Deliverables:

Security audit report, compliance attestation, performance benchmarks.

Torsion Accelerator: Our Enterprise Deployment and Scaling service includes SOC 2 Type II infrastructure, pre-audited compliance workflows, and enterprise-grade security controls.

Weeks 6-8: Pilot Launch, Monitoring, and Full Rollout

Activities:

- Launch pilot with 5% of customer base or select merchant segment

- Monitor transaction success rates, settlement times, and gas costs

- Collect user feedback on checkout experience

- Optimize error handling and retry logic

- Train finance team on reconciliation workflows

- Scale to 100% of eligible transactions

- Implement AI-powered payment routing to select optimal blockchain per transaction

Deliverables:

Production deployment, monitoring dashboards, finance team training materials.

Torsion Accelerator: Our Optimization and Governance service provides MLOps-style continuous monitoring, automated retraining for payment routing models, and AI-driven cost optimization.

Timeline Reality Check

- Basic implementation (Shopify plugin, WooCommerce gateway): 1 week

- Standard custom integration (REST API + ERP): 2-4 weeks

- Complex enterprise system (multi-chain, custom logic, full ERP): 4-8 weeks

- Traditional fintech comparison: Stablecoin integration averages 5 weeks vs. 4 months for traditional payment processor onboarding

Speed factors that help:

- Modern tech stack (cloud-native, microservices architecture)

- Pre-existing API infrastructure

- Technical team with crypto/blockchain experience

- Clear compliance requirements and legal sign-off

Speed factors that hurt:

- Legacy ERP systems requiring custom middleware

- Multi-jurisdictional compliance (US + EU + Asia)

- Internal security review processes requiring 4+ approvals

- First-time crypto integration (learning curve for engineering team)

Compliance and Regulatory Requirements: Navigating GENIUS Act and Beyond

The GENIUS Act: What CTOs Need to Know

The Guiding and Establishing National Innovation for US Stablecoins Act became law on July 18, 2025. Here’s what matters for ecommerce implementations:

For Stablecoin Issuers (Circle, Tether, PayPal):

- 1:1 reserve backing with US currency, Treasury bills, or demand deposits at regulated banks

- Monthly reserve disclosures certified by senior executives under penalty of perjury

- Third-party audits by registered accounting firms (Big 4)

- Federal or state licensing required to operate

- Bank Secrecy Act compliance for AML and sanctions screening

For Businesses Using Stablecoins (your ecommerce company):

- Work with licensed issuers only, USDC (Circle) and USDT (Tether) are compliant

- Customer Identification Program (CIP) same as opening a bank account

- Transaction monitoring for suspicious activity patterns

- Suspicious Activity Reports (SARs) filed with FinCEN when thresholds met

- Travel Rule compliance for transfers >$3,000 (originator and beneficiary data)

The GENIUS Act removed the biggest barrier to enterprise adoption: legal uncertainty. As of October 2025, stablecoins have the same regulatory standing as ACH and wire transfers.

Effective Date: 18 months post-enactment (January 2027) or 120 days after final regulations published, whichever is earlier.

AML/KYC Implementation: The Technical Workflow

Every stablecoin transaction requires identity verification and ongoing monitoring. Here’s the operational architecture:

Customer Due Diligence (CDD) at Onboarding:

- Collect government-issued ID (driver’s license, passport)

- Verify proof of address (utility bill, bank statement)

- Screen against OFAC sanctions lists and PEP databases

- Assign risk score (low, medium, high) based on transaction patterns

- Enhanced Due Diligence (EDD) for high-risk customers (>$50K monthly volume)

Transaction Monitoring (Real-Time):

- Blockchain analytics tools (Chainalysis, Elliptic) screen every wallet address for illicit activity

- Pattern detection flags structuring (breaking $10K+ transactions into smaller amounts to avoid reporting)

- Velocity checks identify sudden spikes in transaction volume

- Geo-blocking restricts transactions from sanctioned countries

Travel Rule Compliance (Transfers >$3,000):

- Collect originator information: name, address, account number

- Verify beneficiary data with receiving institution

- Securely transmit data via encrypted channels (not on-chain)

- Retain records for 5 years as required by Bank Secrecy Act

Suspicious Activity Reporting:

- File SAR within 30 days of detecting suspicious activity

- Common triggers: rapid in-and-out transactions, inconsistent activity with customer profile, transactions with high-risk jurisdictions

- Penalty for non-filing: up to $100,000 per violation

Torsion Integration: Our compliance infrastructure uses Chainalysis Reactor for real-time wallet screening, automated Travel Rule data collection, and pre-built SAR generation workflows that reduce compliance burden by 80%.

International Regulatory Frameworks: Beyond the United States

If you operate globally, you’re navigating multiple compliance regimes:

European Union: MiCA (Markets in Crypto-Assets)

- Similar to GENIUS Act: 1:1 reserve backing, monthly audits, licensing requirements

- E-Money Institution (EMI) license or banking license required for issuers

- Consumer protection rules for redemptions and disclosures

- Effective: June 2024 (already in force)

Singapore: Payment Services Act

- Major Payment Institution license for stablecoin issuers

- AML/CFT compliance through Monetary Authority of Singapore (MAS)

United Kingdom: FCA Registration

- Cryptoasset firms must register with Financial Conduct Authority

- AML/KYC requirements aligned with EU standards

UAE: VARA (Virtual Assets Regulatory Authority)

- Dubai and Abu Dhabi have separate licensing regimes

- Stablecoin payment services require Virtual Asset Service Provider license

Cross-Border Strategy: Work with multi-jurisdictional custody providers (Fireblocks supports 50+ countries) and use geo-routing to direct transactions through compliant rails per customer location.

Accounting and Tax Treatment: How Stablecoins Appear on Financial Statements

This is where CFOs and controllers get nervous. Here’s the authoritative guidance based on Big 4 accounting firm publications:

Balance Sheet Classification:

- Cash equivalents if stablecoin meets three tests: (1) redeemable on demand at 1:1, (2) issuer is regulated and audited, (3) highly liquid market exists

- USDC and USDT qualify under GENIUS Act framework

- Financial instruments under IFRS 9 if contractual redemption rights exist

- Intangible assets for algorithmic or crypto-backed stablecoins (not recommended for enterprise use)

Revenue Recognition:

- Stablecoin sales recognized same as cash sales at transaction date

- No special treatment required for ASC 606 revenue recognition

Foreign Currency Translation:

- USD-backed stablecoins (USDC, USDT) have no FX gain/loss since pegged to US dollar

- Eliminates 90% of FX accounting complexity vs. multi-currency fiat

Tax Implications (as of October 2025):

- IRS still treats stablecoins as property for federal tax purposes (unless new guidance issued)

- Each transaction may trigger taxable event if basis differs from redemption value

- Capital gains/losses reported on Schedule D

- 1099-DA reporting required for brokers and payment processors

- Practical impact: For dollar-pegged stablecoins held <24 hours (payment use case), capital gains are typically $0 since acquisition and disposition prices are identical

What Auditors Need to See:

- Transaction IDs (blockchain provides immutable audit trail)

- Reserve audit reports (Circle publishes monthly; Tether quarterly)

- Custody confirmations from Fireblocks or Anchorage

- KYC documentation trail for each customer

- Internal controls documentation for wallet access and approval workflows

Torsion Advantage: Our Enterprise Deployment service includes pre-built accounting integrations for NetSuite, SAP, and QuickBooks with automated journal entries, reconciliation workflows, and audit report generation.

Security and Risk Management: Protecting the Payment Infrastructure

Smart Contract Vulnerabilities and Mitigations

Stablecoin transactions execute through smart contracts, code that handles token transfers, approvals, and settlement logic. These contracts are targets for exploits:

Common Vulnerability Patterns:

- Reentrancy attacks: Malicious contract calls token contract recursively before balance updates

- Integer overflow/underflow: Arithmetic errors cause incorrect balance calculations

- Access control flaws: Unauthorized addresses can call admin functions

- Oracle manipulation: Price feed exploits in DeFi integrations

Mitigation Strategies:

- Professional security audits by firms like Trail of Bits, OpenZeppelin, or CertiK

- Formal verification using mathematical proofs to validate contract logic

- Bug bounty programs with $100K+ rewards for critical vulnerabilities

- Multi-signature controls requiring 2-of-3 or 3-of-5 approvals for administrative functions

- Time delays for critical operations (12-hour delay for contract upgrades)

- Emergency pause functionality to halt transactions if exploit detected

For Ecommerce CTOs: If using Circle USDC or Tether USDT directly (not custom contracts), smart contract risk is minimal, these tokens have been battle-tested with billions in TVL and undergo continuous audits. Risk increases if you build custom payment logic on top of base stablecoins.

Custody, Key Management, and HSM Controls

Private key security is the single point of failure. Best practices from enterprise blockchain security whitepapers:

Hardware Security Modules (HSMs):

- Store private keys in FIPS 140-2 Level 3 certified hardware devices

- Keys never leave the HSM, signing happens inside the secure enclave

- Fireblocks uses MPC (multi-party computation) to distribute key shares across multiple HSMs

Multi-Signature Wallets:

- Require 3-of-5 signatures for transactions >$100K

- Distribute signing authority: CTO, CFO, Head of Finance, Custodian 1, Custodian 2

- Prevents single employee from draining company funds

Role-Based Access Controls (RBAC):

- Finance team can initiate transactions but not approve

- Engineering team has read-only access to transaction logs

- Executive team provides final approval via hardware wallet (Ledger, Trezor)

Key Rotation and Backup:

- Rotate wallet addresses every 90 days to limit exposure

- Backup encrypted key shards in geographically distributed secure locations

- Test recovery process quarterly to ensure backups work

Operational Security Measures:

- Network segmentation: Payment infrastructure on isolated VLAN

- Encrypted communications: TLS 1.3 for all API calls

- Distributed nodes: Run blockchain nodes in 3+ availability zones

- Intrusion detection: Real-time alerting for unauthorized access attempts

- API rate limiting: Prevent brute-force attacks on authentication endpoints

Torsion Security Architecture: Our Scalable Infrastructure Implementation service deploys SOC 2 Type II certified infrastructure with enterprise-grade HSMs, multi-signature wallets, and 24/7 security monitoring.

Economic Risks: Liquidity, Depegging, and Reserve Transparency

Liquidity Risk:

- Can you redeem stablecoins for dollars during market stress?

- USDC redeems 1:1 through Circle with T+1 settlement

- USDT redeems through Tether with 24-hour processing

- Market depth: USDC has $10B+ daily trading volume across exchanges

Depegging Risk (stablecoin trading below $1.00):

- Historical data: USDC and USDT have maintained 0.995–1.005 range for 3+ years

- Worst case: USDC depegged to $0.92 in March 2023 during Silicon Valley Bank crisis but recovered within 48 hours

- Your exposure: Minimal if holding stablecoins for <24 hours (payment use case)

- Mitigation: Use auto-conversion to fiat immediately upon settlement

Reserve Transparency Requirements:

- Circle publishes monthly reserve reports audited by Deloitte

- Tether publishes quarterly reports with breakdown of reserve assets

- As of Q2 2025: Circle held $61B in reserves (100% cash and short-term Treasuries); Tether held $98.5B in US Treasury bills

- Real-time proof-of-reserves dashboards available at circle.com/transparency

Red Flags to Avoid:

- Algorithmic stablecoins (Terra/Luna-style) with no reserves

- Crypto-backed stablecoins with volatile collateral

- Issuers without monthly audits or regulatory licensing

Torsion Risk Management: Our Advanced Analytics and Cost Management service monitors stablecoin market conditions in real-time, automatically switches to backup stablecoins if depeg risk exceeds thresholds, and provides treasury teams with daily reserve health dashboards.

Platform-Specific Integration Paths: Shopify, WooCommerce, and Custom APIs

Path 1: Shopify + Stripe + Coinbase Commerce (Fastest Launch)

What Changed in June 2025:

Shopify partnered with Coinbase to enable USDC on Base (Coinbase’s Layer 2 network) through Shopify Payments, no third-party gateway required.

Technical Implementation:

- Enable Shopify Payments in admin dashboard

- Toggle USDC payments (appears alongside credit card options)

- Customers connect wallet (MetaMask, Coinbase Wallet, Phantom, or 100+ others)

- Transactions settle on Base blockchain with <$0.01 fees

- Auto-conversion to local fiat (default) or withdraw USDC to external wallet

Coverage: 34 countries initially (US, Canada, EU, UK, Singapore, Australia, more).

Fees: Shopify takes standard payment processing fee (2.9% + $0.30) but pays blockchain costs; merchants save on FX fees. Coming soon: up to 0.50% rebates for US merchants.

Timeline: 1-2 hours to enable in Shopify admin.

Best For: Shopify merchants wanting instant access to stablecoin payments without custom development.

Limitations: Locked to Base blockchain; no multi-chain support; limited customization of checkout flow.

Path 2: WooCommerce + Crypto Payment Gateways (Plugin-Based)

Available Gateway Options:

CoinGate (most established):

- Supports USDC, USDT, PYUSD, and 70+ other cryptocurrencies

- Auto-conversion to fiat or settle in crypto

- Fees: 1% for crypto settlement, 1% + EUR processing fee for fiat conversion

- Integration time: 5-10 minutes via WordPress plugin

CryptoPay (zero-fee option):

- Peer-to-peer direct payments (no intermediary)

- 0% fees if settling in crypto

- Networks: Ethereum, Polygon, Solana, Binance Smart Chain, Tron, Avalanche

- Integration time: 10 minutes via plugin

TripleA (enterprise-focused):

- 1.0% settlement fee

- Built-in compliance tools and transaction monitoring

- Priority support for high-volume merchants

DePay (Web3-native):

- Decentralized payment gateway (no custody)

- Supports 15+ blockchains

- Dynamic routing selects cheapest network per transaction

Timeline: 1 day including testing (plugin install + configuration + test transactions).

Best For: WooCommerce stores wanting quick stablecoin integration with minimal development.

Limitations: Plugin compatibility issues with some WooCommerce extensions; limited customization of payment flow.

Path 3: Custom Enterprise APIs (Maximum Control)

When Custom Integration Makes Sense:

- Transaction volume >$10M annually

- Custom approval workflows required

- Multi-system integration (ERP, CRM, treasury)

- Need for AI-powered payment routing optimization

API Provider Options:

Circle Gateway:

- Unified USDC balance across 9 blockchains (Ethereum, Solana, Polygon, Avalanche, etc.)

- REST API for payments, payouts, and account management

- Fireblocks partnership provides institutional custody

- Pricing: Contact for enterprise rates

Fireblocks API:

- Enterprise-grade custody with MPC wallet infrastructure

- Supports 50+ blockchains and 1,000+ tokens

- Policy engine for approval workflows (3-of-5 signatures, amount thresholds)

- Pricing: Based on transaction volume

Iron.xyz:

- Turnkey stablecoin payment APIs

- Pre-built checkout components and webhook handlers

- Fast integration for developers

Fipto:

- Global stablecoin infrastructure

- Multi-currency support and FX optimization

Integration Architecture:

- Checkout flow: Customer selects stablecoin payment → API call to Circle/Fireblocks generates payment address

- Transaction monitoring: Webhook receives confirmation from blockchain network (2-10 seconds)

- ERP sync: Middleware pushes transaction data to NetSuite/SAP with journal entry

- Treasury settlement: Auto-conversion to fiat via Stripe Treasury or manual withdrawal to bank

Timeline: 2-8 weeks depending on existing infrastructure complexity.

Best For: Mid-market to enterprise ecommerce companies with technical resources and custom requirements.

Torsion Custom Integration: Our Proof of Concept Development service delivers a working API integration in 2 weeks using pre-built templates for Circle, Fireblocks, and major ERP systems (NetSuite, SAP, QuickBooks).

The Torsion Advantage: Why AI Execution Expertise Matters for Payment Infrastructure

Torsion isn’t a blockchain consultancy. We’re an AI execution partner that applies the same end-to-end lifecycle methodology to payment modernization that we use for enterprise AI transformation.

End-to-End Lifecycle: Strategy → Execution → Optimization

Discovery and Strategy (Weeks 1-2):

- Map current payment costs and identify high-ROI stablecoin opportunities

- Define blockchain selection criteria based on transaction profiles

- Assess compliance requirements across operating jurisdictions

- Deliver vendor evaluation matrix and technical architecture blueprint

Proof of Concept Development (Weeks 2-4):

- Build working API integration to Circle or Fireblocks in sandbox

- Create ERP middleware for NetSuite, SAP, or QuickBooks

- Implement KYC/AML workflows with Chainalysis integration

- Validate end-to-end transaction flows with testnet USDC

Enterprise Deployment and Scaling (Weeks 4-8):

- Deploy production infrastructure with SOC 2 Type II certified custody

- Integrate AI-powered payment routing to select optimal blockchain per transaction

- Train finance and compliance teams on reconciliation and reporting

- Launch pilot and scale to full production

Optimization and Governance (Ongoing):

- MLOps-style continuous monitoring of transaction success rates and costs

- Automated retraining for payment routing models based on network congestion

- Compliance governance with automated Travel Rule reporting and SAR generation

- Quarterly security audits and penetration testing

AI-Driven Payment Orchestration: The Competitive Edge

Traditional stablecoin integrations use static routing: every transaction goes through the same blockchain network regardless of current costs or congestion.

Torsion’s AI orchestration layer dynamically selects the optimal route based on:

- Gas fees (Solana $0.00025 vs. Ethereum $15)

- Network congestion (Polygon throughput vs. Base availability)

- Transaction value (high-value → Ethereum security; low-value → Solana speed)

- Settlement urgency (instant refund → Layer 2; bulk payout → batch on Ethereum)

Result: 30-50% cost reduction vs. single-chain implementations by routing low-value transactions to Solana and high-value to Ethereum.

Compliance-First, Mid-Market Focus

Big consultancies (Deloitte, Accenture) build stablecoin infrastructure for Fortune 500 but ignore mid-market companies.

Boutique crypto firms lack the enterprise experience to navigate ERP integrations and audit requirements.

Torsion sits in the whitespace: we deliver enterprise-grade infrastructure with mid-market agility. Our compliance-first approach embeds GENIUS Act requirements, Travel Rule automation, and SAR generation into every implementation, not as an afterthought.

Ethical AI and Transparency Standards

Torsion’s Ethics and Trust at the Core principle applies to payment infrastructure:

- Transparent fee structures (no hidden blockchain costs)

- Customer data privacy (minimal KYC data collection)

- Open IP and vendor flexibility (no lock-in to single custody provider)

- Bias-free payment routing (AI models audited for fairness)

You control the infrastructure. We provide the expertise to build it right.

Getting Started: Torsion’s Stablecoin Integration Playbook

Pre-Integration Checklist

Before scheduling an implementation kickoff, validate these prerequisites:

Business Requirements:

- Annual payment volume >$10M (ROI threshold for custom integration)

- International customer base or cross-border B2B payments

- High chargeback rates or payment processor rejections

- Executive alignment on crypto payment strategy

Technical Requirements:

- Modern tech stack (cloud-native, API-driven architecture)

- Engineering resources available for 4-8 week project

- Existing payment gateway with webhook support

- ERP system with API access (NetSuite, SAP, QuickBooks, Xero)

Compliance Requirements:

- Legal sign-off on stablecoin payment acceptance

- KYC/AML policies aligned with Bank Secrecy Act

- Accounting guidance on balance sheet treatment

- Tax strategy for stablecoin transactions

Risk Tolerance Assessment:

- Comfortable with <1% depegging risk for <24 hour holdings

- Willing to implement multi-signature custody controls

- Prepared for customer education on wallet setup

Stakeholder Alignment Framework

Stablecoin integration requires buy-in across functions:

CTO/VP Engineering: Technical feasibility, timeline, resource allocation

CFO/Controller: Accounting treatment, tax implications, audit requirements

Head of Compliance/Legal: Regulatory obligations, KYC/AML workflows, licensing

Head of Finance/Treasury: Custody model, settlement timing, FX risk management

Chief Revenue Officer: Customer adoption strategy, checkout UX, market expansion

Torsion Facilitation: Our Discovery and Strategy service includes stakeholder alignment workshops with function-specific briefing materials (CTO technical architecture, CFO accounting guidance, Legal compliance checklist).

Decision Matrix: Which Blockchain for Your Use Case?

| Use Case | Transaction Volume | Value per Tx | Recommended Blockchain | Rationale |

| Consumer Ecommerce | >10,000/day | <$500 | Solana or Base | Near-zero fees, high throughput |

| B2B Supplier Payments | 100-1,000/day | $5K-$50K | Polygon or Ethereum | Moderate cost, high security |

| International Wire Replacement | 10-100/day | $10K-$500K | Ethereum mainnet | Maximum security, acceptable cost for value |

| Subscription Billing | 1,000-10,000/day | $10-$100 | Base (Coinbase L2) | Optimized for recurring payments |

| Refund Processing | 500-5,000/day | $50-$500 | Polygon | Fast finality, low cost |

Multi-Chain Strategy: Use Torsion’s AI orchestration to route dynamically based on current network conditions rather than static rules.

What’s Next: The Future of Enterprise Stablecoin Infrastructure

Programmable Rewards and Loyalty

Coinbase and Shopify are building on-chain loyalty programs where stablecoin payments earn programmable rewards redeemable for NFTs, token-gated experiences, or partner merchant discounts. Launch expected Q1 2026.

Impact: Reduces customer acquisition costs by 20-30% through viral referral mechanics and composable loyalty across merchant networks.

Cross-Chain Interoperability and Aggregation

Fireblocks and Circle’s September 2025 partnership aims to unify USDC balances across 9+ blockchains into a single liquidity pool. Merchants won’t need to choose networks, the infrastructure will auto-route based on cost and speed.

Impact: Eliminates blockchain selection complexity; payment systems become blockchain-agnostic.

AI-Powered Compliance Automation

Torsion is building AI governance agents that continuously monitor regulatory changes (GENIUS Act amendments, MiCA updates, new jurisdictions) and automatically update compliance workflows.

Impact: Reduces compliance engineering effort by 80%; ensures real-time regulatory alignment across 50+ jurisdictions.

Treasury Management Integration

Stablecoin yields (4-5% on USDC through DeFi protocols) will integrate directly into treasury platforms like Stripe Treasury and Modern Treasury. Idle payment balances earn yield automatically.

Impact: Payment float becomes revenue center instead of dead capital; CFOs earn $50K-$500K annually on working capital.

Start Your Stablecoin Integration Assessment

Torsion’s 3-Step Onboarding Process:

Step 1: 15-Minute Consultation (No Commitment)

- Map your current payment costs and pain points

- Identify highest-ROI stablecoin opportunities

- Assess technical feasibility and timeline

Step 2: Custom Recommendation (If Qualified)

- Technical architecture blueprint specific to your stack

- Cost-benefit analysis with 3-year ROI projection

- Vendor selection matrix (Fireblocks vs. Circle vs. custom)

- Compliance roadmap for your jurisdictions

Step 3: Implementation Roadmap (Pre-Contract)

- Week-by-week timeline with resource requirements

- Risk assessment and mitigation strategies

- Pilot launch plan and success metrics

- Pricing and SOW (only after confirming fit)

No crypto experience required. No blockchain knowledge assumed. Just clarity on whether stablecoins can cut your payment costs by 95% while expanding your market by 10x.

Schedule your Torsion Stablecoin Integration Assessment: [Book 15-Minute Call]