TL;DR

- Cross-border payments cost 1-5% in fees plus 2-5% in hidden FX markups

- Payment infrastructure blocks market entry more than CFOs realize

- Geographic fragmentation creates hidden barriers

- Local payment preferences vary dramatically by region

- Regulatory evolution is creating new opportunities

- Modern payment infrastructure addresses these limitations

Here’s a counterintuitive fact: While cross-border payment flows exceeded $150 trillion globally in 2022, the world’s “global” payment systems have surprisingly local limitations.

Your company might process domestic transactions flawlessly. You’ve optimized for speed, reduced fees, and integrated seamlessly with your financial systems. But the moment you decide to expand internationally, whether that means accepting payments from customers in Southeast Asia or paying suppliers in Latin America, you hit invisible walls that cost real money and block real growth.

These aren’t technical glitches. They’re structural limitations built into the payment infrastructure that most CFOs inherit without questioning. And they’re quietly constraining your international expansion strategy in ways that don’t show up clearly on financial statements until you add up the cumulative impact.

95% of financial professionals say if they had an easier way to deal with exchange rates, they could increase global expansion efforts.

The question isn’t whether these limitations exist. The question is whether you’ve quantified what they’re actually costing you and whether alternatives exist that your competitors might already be evaluating.

The Numbers Behind the Problem: What International Payments Actually Cost

Before diving into why these barriers exist, let’s establish what they cost.

The Direct Financial Drain

Cross-border B2B payment fees range from 1-3% for large corporates and over 5% for SMEs using correspondent banking networks. That’s the visible charge on your invoice. But the real cost extends far beyond the transaction fee line item.

SWIFT transactions typically take 2-5 days to reach recipient accounts, tying up working capital that could be deployed elsewhere. For a company managing $10M in monthly international payments, that’s $1-2M in capital constantly in transit, neither available for investment nor earning returns.

The Revenue You’re Not Capturing

Payment failure rates tell a sobering story: 40% of customers who reach the payment stage don’t complete transactions. Of these, roughly 20% are false declines, legitimate customers whose payments are rejected by overzealous fraud systems or incompatible payment infrastructure.

In Europe alone, false declines cause over €20 billion of lost retail sales annually. These aren’t customers who changed their minds. They’re customers who wanted to pay but couldn’t because your payment infrastructure couldn’t accommodate them.

False declines cause over €20 billion of lost retail sales annually in Europe, customers who wanted to pay but couldn’t.

The growth opportunity being missed is substantial. Cross-border consumer-to-business payments are projected to grow at 11% CAGR from 2023-2030, with Latin America’s cross-border ecommerce market alone expected to exceed $100 billion by 2026.

Your current payment infrastructure might be optimized for markets you’re already in. But is it ready for markets you need to enter?

Geographic Coverage: The Map Your Payment Processor Doesn’t Show You

When you signed up with your payment processor, you probably reviewed their “global coverage” documentation. It looked impressive, 200+ countries, dozens of currencies, regional expansion underway.

What that documentation doesn’t show you clearly is the fragmentation underneath.

The Regional Reality Check

North America dominated the payment processor market with 32.2% revenue share in 2024, but this reflects domestic strength, not international reach. American payment infrastructure works exceptionally well within American borders. Cross those borders, and complexity multiplies.

Europe shows mixed trends under PSD3 regulations while broadening third-party access. European payment integration has advanced through regulatory mandates, but interoperability with non-European systems remains challenging.

Asia-Pacific leads growth at 14.48% CAGR, driven by mobile-first consumption and real-time payment links. This is where the most dramatic payment innovation is happening, and where Western payment processors often struggle with market-specific requirements.

Africa and the Middle East present long-run upside but face licensing fragmentation that inflates setup costs. Each country maintains separate regulatory frameworks, payment preferences, and infrastructure requirements.

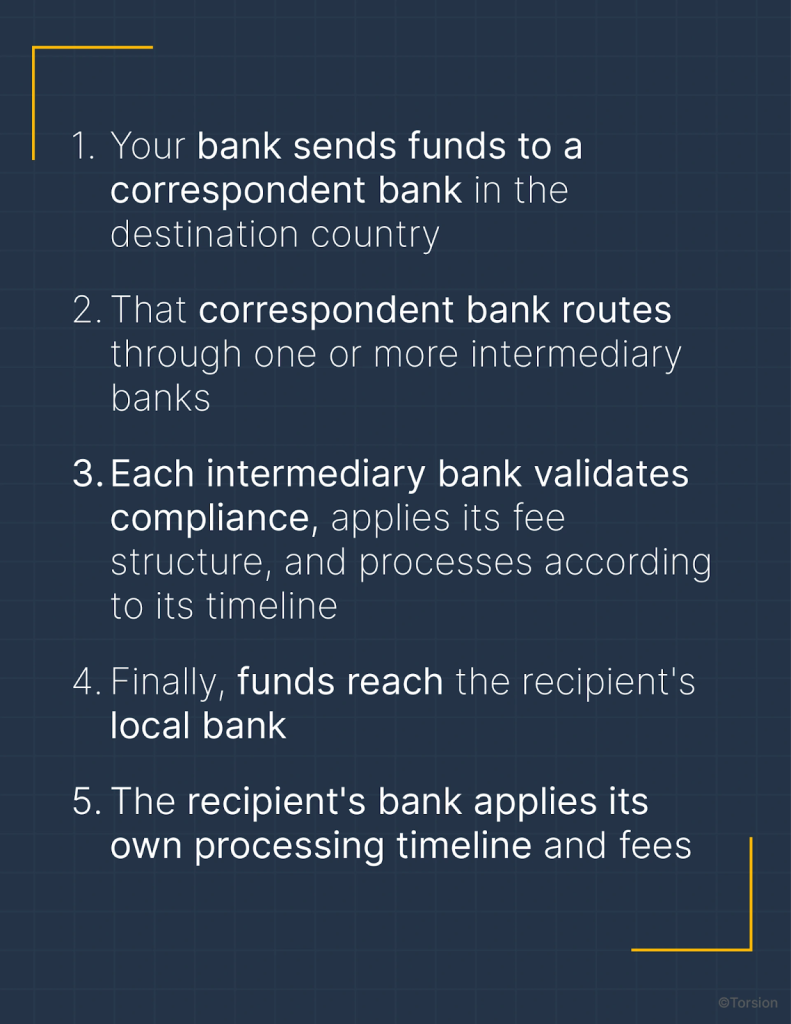

The Correspondent Banking Chain Nobody Explains

Here’s what happens when you send an international wire transfer through traditional banking infrastructure:

Each country maintains separate payment systems with unique regulations across 195 countries. Each intermediary bank takes a cut and adds processing time. The fragmented global infrastructure creates technical obstacles with limited compatibility between regional systems.

You’re not just paying transaction fees. You’re paying a series of banks to translate between incompatible systems, systems that were built independently over decades without interoperability in mind.

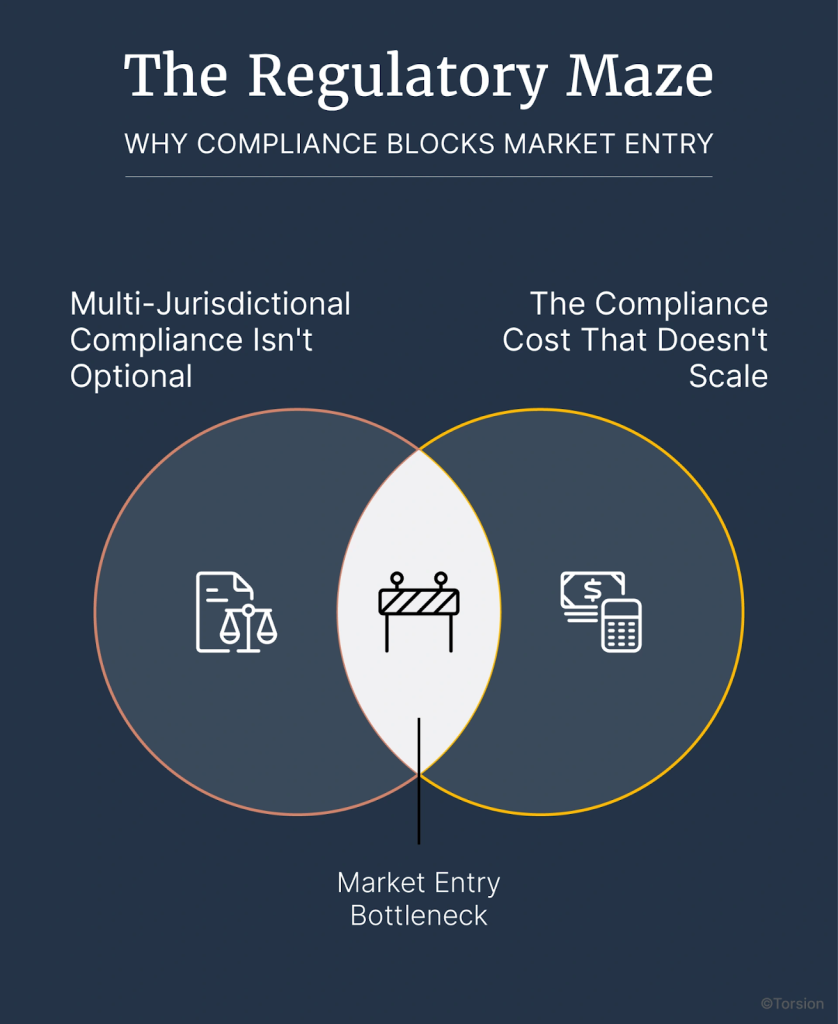

The Regulatory Maze: Why Compliance Blocks Market Entry

If geographic fragmentation were the only challenge, it would be manageable. But layered on top of geographic complexity is regulatory fragmentation that makes international payments exponentially more difficult.

Multi-Jurisdictional Compliance Isn’t Optional

Cross-border payments are subject to regulatory requirements of the origin country, destination country, and any jurisdictions they pass through. Each jurisdiction applies different AML, KYC, reporting limits, and compliance procedures.

Different regulatory authorities may require specific information without collaborating, leading to fragmentation. You might satisfy compliance requirements in your home country perfectly, but that doesn’t automatically translate to compliance in your destination country.

Data localization rules create additional barriers. Some countries require domestic processing or prohibit foreign payment methods entirely. This isn’t protectionism for its own sake, it’s governments asserting control over financial flows and data within their borders.

The Compliance Cost That Doesn’t Scale

Complex documentation requirements vary by country. FIRA certificates, export documentation, tax compliance frameworks, each market has its own paperwork requirements that must be satisfied before payments can flow.

Regulatory compliance procedures can result in payment service suppliers “de-risking”, refusing to process payments for certain countries, industries, or transaction types because the compliance cost exceeds the profit potential. This disproportionately impacts smaller businesses trying to expand internationally.

Cross-border payments are subject to regulatory requirements of the origin country, destination country, and any jurisdictions they pass through.

You’re building a business that needs to scale internationally. But compliance costs that increase linearly with each new market create a scaling problem that limits expansion velocity.

The Hidden CFO Costs: Beyond Transaction Fees

Let’s quantify the real impact on your financial operations.

Working Capital Impact: The Money in Transit

When payments take 2-5 days to settle, that capital isn’t earning returns. It’s not available for inventory purchases, vendor negotiations, or strategic investments. It’s simply in transit.

For a manufacturing company with $5M in monthly supplier payments, a 3-day average settlement delay means roughly $500K is constantly in transit. That’s $500K you can’t deploy, can’t invest, and can’t use to negotiate better terms with suppliers who prefer immediate payment.

Limited visibility into payment status during the 2-5 day transfer journey complicates cash flow planning. You don’t know exactly when funds will arrive. Your suppliers don’t know when to expect payment. This uncertainty affects production schedules, inventory management, and supplier relationships.

The Manual Reconciliation Tax

Double currency conversions add multiple fee layers. A payment from Europe to Southeast Asia might convert EUR → USD → local currency, with fees and FX markups applied at each conversion.

Manual reconciliation processes for multi-currency transactions increase back-office costs. Your accounting team spends hours matching payments to invoices, accounting for FX rate differences, and resolving discrepancies that wouldn’t exist in a single-currency environment.

These aren’t strategic activities. They’re friction costs, time and money spent managing complexity instead of driving growth.

Opportunity Costs: The Markets You’re Not Entering

Requirements to use specific payment methods in countries can discourage market entry entirely. If entering a market requires integrating payment methods you’ve never heard of, supported by infrastructure you don’t have, the barrier to entry suddenly looks much higher.

59% of consumers abandon carts when unable to pay with preferred payment method. This is about trust and familiarity. A customer in Brazil who sees only credit card options might abandon the purchase, while a customer in China who doesn’t see WeChat Pay or Alipay might do the same.

Each market you delay entering is a market where competitors establish position. Each customer you lose to payment friction is revenue that funds your competitor’s next expansion phase.

Local Payment Methods: The Integration Challenge

The payment method landscape isn’t converging toward global standards. It’s fragmenting toward local preferences.

Regional Payment Dominance You Can’t Ignore

China: WeChat Pay and Alipay are nearly prerequisites for doing business. These aren’t alternatives to credit cards, they’re the primary payment methods for hundreds of millions of consumers. If your payment infrastructure doesn’t support them, you’re effectively locked out of the market.

Brazil: PIX account-to-account payments dominate with 74% usage growth. This government-backed instant payment system has become the default payment method for Brazilian consumers and businesses. Not supporting PIX isn’t a minor inconvenience, it’s a competitive disadvantage.

Southeast Asia: GCash, GrabPay preferred in markets where 60-70% lack traditional bank accounts. Mobile money systems have leapfrogged traditional banking infrastructure in these markets. Your Western payment processor’s credit card infrastructure is solving for the wrong problem.

Africa: Mobile money preferred, with cash-on-delivery used in nearly half of e-transactions. The infrastructure assumptions that work in developed markets don’t translate to African payment preferences.

The Network Effect Problem

Many local payment systems operate only at national level without cross-border interconnection. There’s no universal translator that lets you integrate once and support dozens of local payment methods.

Merchants face a choice: integrate dozens of local systems individually (which requires technical resources and ongoing maintenance) or lose conversion in key markets (which limits growth potential).

59% of consumers abandon carts when unable to pay with preferred payment method, and each abandonment funds your competitor’s expansion.

Neither option is appealing. But the status quo, attempting international expansion with payment infrastructure designed for domestic markets, increasingly looks like the worst option.

The Infrastructure Modernization Gap

Even when payment processors technically support a country, the underlying infrastructure limitations create friction.

Legacy System Limitations

SWIFT’s MT103 messaging format is reliable but limited in information capacity. It was designed decades ago for a different era of international finance. It works, but it doesn’t work efficiently by modern standards.

Different countries use proprietary formats while some follow ISO 8583 for card payments. System incompatibility requires translation between formats, adding time and error risk to every transaction.

Each intermediary bank maintains separate compliance procedures and timelines. There’s no centralized coordination, just a chain of independent institutions, each operating according to its own processes.

Settlement Network Realities

Correspondent banking relationships must be established for each currency/country combination you want to support. Your bank can’t simply send money anywhere, it needs relationships with banks in destination countries, and those relationships take time and resources to establish.

Limited interoperability between faster domestic payment systems internationally means that while domestic payments might settle instantly within certain countries, moving money between countries still relies on slower correspondent banking infrastructure.

The infrastructure modernization you’ve implemented domestically with real-time payments, instant settlement, integrated accounting, often doesn’t extend internationally.

Strategic Impact: How Payment Limitations Constrain Growth

These operational inefficiencies have strategic consequences.

Growth Strategy Implications

International expansion plans get limited by payment infrastructure availability. When evaluating new markets, CFOs typically analyze market size, competitive landscape, regulatory environment, and operational complexity. But payment infrastructure often gets overlooked until it becomes a blocking issue.

Market entry decisions become influenced by payment method requirements versus expected conversion rates. A market with strong growth potential might require payment integrations that your current infrastructure can’t support. Do you delay market entry while building payment capabilities? Or do you enter with suboptimal payment options and accept lower conversion?

You face competitive disadvantage against local players with native payment integration. A local competitor doesn’t need to figure out how to support PIX or WeChat Pay, they already support it by default. You’re starting from behind.

Working Capital Management Challenges

Delayed settlements impact cash conversion cycles and inventory financing. When you can’t predict exactly when payments will arrive, financial planning becomes more art than science.

Unpredictable payment timing complicates forecasting. Your financial models assume certain collection timelines, but international payment delays introduce variance that makes those models less reliable.

FX risk exposure increases with longer settlement windows. The longer money is in transit, the more exposed you are to currency fluctuations that can erase margin.

Payment infrastructure limitations transform market expansion from a strategic choice into a technical constraint.

These aren’t just operational inconveniences. They’re strategic constraints that limit your ability to capitalize on growth opportunities at the pace required to maintain competitive position.

The Regulatory Evolution Creating New Possibilities

While legacy systems create barriers, regulatory evolution is creating new opportunities.

Recent Infrastructure Progress

UPI-Singapore PayNow linkage enables real-time transfers since 2023. This represents a new model, bilateral agreements between faster payment systems that bypass traditional correspondent banking entirely.

Japan mandated 3-D Secure from April 2025 to combat ¥54.09 billion in fraud. Security requirements are increasing, but so are the technical standards that enable secure, instant transactions.

PSD3 in Europe strengthens consumer protection while broadening third-party access. Regulation isn’t just creating barriers, it’s also mandating interoperability that reduces fragmentation.

Alternative Infrastructure Emergence

Instant cross-border payment corridors are expanding beyond traditional correspondent banking. Real-time payment system linkages prove that faster, cheaper alternatives exist when infrastructure is purpose-built for modern requirements.

Stablecoin infrastructure is being adopted by FX providers for backend operations. Even traditional financial institutions are experimenting with blockchain-based settlement layers that reduce intermediary costs and settlement times.

The regulatory landscape for these alternatives is maturing. The GENIUS Act provides federal stablecoin framework in the US. MiCA framework establishes regulatory clarity in Europe. These regulations don’t just permit alternatives, they legitimize them as compliant, regulated financial infrastructure.

What This Means for Your International Expansion Strategy

The infrastructure limitations outlined aren’t theoretical. They’re actively constraining your growth.

The CFO Decision Framework

First, audit the total cost of your current international payment infrastructure. Include transaction fees, FX markups, working capital cost of delayed settlements, back-office reconciliation costs, and opportunity cost of markets you’re not entering due to payment barriers.

Second, map current geographic coverage gaps against your growth opportunities. Which markets represent the highest potential? Which markets face the highest payment barriers? Where’s the mismatch between strategic priority and payment capability?

Third, evaluate working capital impact of 2-5 day settlement delays. Calculate the average amount in transit at any given time. What’s the opportunity cost of that capital? How does instant settlement change your working capital position?

Finally, consider emerging payment infrastructure that addresses traditional limitations. The payment landscape is evolving rapidly. Infrastructure that seemed exotic or risky five years ago is becoming regulated, audited, and adopted by traditional financial institutions.

The Strategic Imperative

Modern CFOs must treat international payment infrastructure as strategic, not operational. Payment method availability directly impacts market entry success and customer conversion. Alternative payment infrastructure solutions now exist that address traditional limitations.

The question isn’t whether to expand internationally, most growth strategies require it. The question is whether your payment infrastructure enables that expansion or constrains it.

Modern CFOs must treat international payment infrastructure as strategic, not operational.

Your competitors are evaluating these trade-offs. Some are moving forward with infrastructure alternatives. Others are accepting the constraints of legacy systems and adjusting growth strategies accordingly.

The cost of inaction isn’t zero. It’s the cumulative impact of payment barriers multiplied across every international transaction, every potential market, and every customer you lose to payment friction.

The Path Forward

Legacy payment systems weren’t designed for today’s international expansion requirements. They were built for an era when cross-border commerce moved more slowly, when geographic expansion happened market by market over years, and when payment infrastructure was purely operational rather than strategic.

That era is over.

Your growth strategy requires payment infrastructure that supports instant settlement, manages multi-currency complexity efficiently, accommodates local payment preferences, and scales without adding proportional compliance overhead.

These requirements aren’t theoretical. They’re the practical realities of international expansion in 2025.

The financial impact of payment infrastructure limitations is quantifiable: transaction fees of 1-5%, FX markups of 2-5%, working capital tied up for 2-5 days, false declines costing 20% of attempted transactions, and market entry delayed or abandoned due to payment integration complexity.

Alternative infrastructure exists that addresses these limitations. The regulatory frameworks enabling these alternatives are maturing. Traditional financial institutions are beginning to adopt them for backend operations.

The strategic question for CFOs isn’t whether these barriers exist, the data confirms they do. The strategic question is whether continuing with infrastructure designed for a previous era of international commerce makes sense when alternatives designed for current requirements are available.

Your international expansion strategy deserves payment infrastructure built for international expansion.