Key Takeaways

- 80% of AI projects in finance fail to deliver measurable business value, despite massive investment.

- $650 billion was invested globally in AI by financial institutions in 2023, yet the vast majority of these projects produced no significant returns.

- Organizations that successfully escape this trap achieve 20–30% gains in operational efficiency and realize up to 75% greater ROI on their AI initiatives.

- The solution is a breakthrough lifecycle framework that 80% of firms completely overlook.

In 2023, financial institutions poured an eye-watering $650 billion into artificial intelligence, expecting transformational returns. But here’s the shocking twist: nearly 80% of these AI projects never deliver measurable business value.

Only 15–20% of AI initiatives ever reach full deployment, and a tiny 8% actually move the needle on revenue or efficiency. Confidence at the executive level has taken a nosedive from 69% in 2023 down to just 58% in 2025.

- Why do so many potentially game-changing projects get stuck?

- What silent obstacles lurk behind stalled AI efforts in top banks and financial firms?

- And what exactly separates the 20% who break free from this cycle and generate real, quantifiable ROI?

In this analysis, we’ll uncover the surprising reasons behind this massive AI gap and reveal the proven framework industry leaders use to finally crack the code and unlock AI’s true potential.

The Anatomy of the AI Project Trap: Why Do 80% of Initiatives Stall?

Imagine pouring millions into a state-of-the-art AI project, only to watch it go nowhere. What’s happening behind the scenes that’s silently bleeding money and morale? The truth is more unsettling than you might think.

Nearly 80% of AI projects in the financial services sector never even go live. But here’s the kicker: even among the few that do, 70% produce little to no measurable business value.

- What hidden forces are causing these promising projects to stall?

- How can seemingly minor technical glitches and quiet cultural resistance combine to sabotage innovation?

- And what about the executives tasked with steering these efforts: are they set up for success, or are they caught in a confidence crisis they can’t see?

Consider the financial drain. An average AI project that fails to deliver can cost an organization between $25,000 and $75,000 every single month. Now, add in cloud computing waste where nearly 80% of firms admit that up to half of their AI-related cloud spending is literally vanishing into thin air on unused resources.

You start to see how profits are leaking away completely unnoticed.

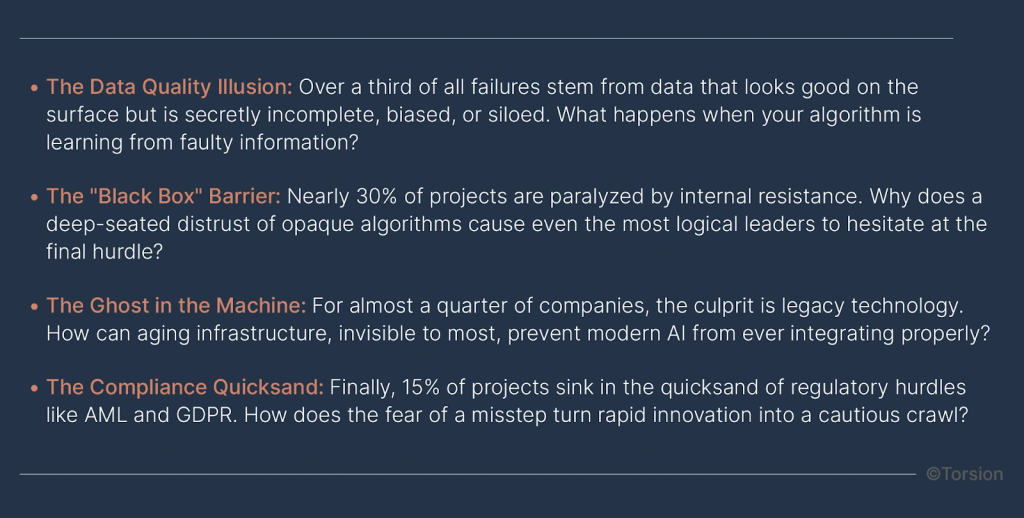

So, why do so many organizations keep falling into this same expensive trap? The data reveals a pattern of four silent killers:

But there’s an even deeper issue at play. Only 55% of executives feel they are truly equipped to navigate the risks and opportunities AI presents. This confidence gap at the top creates a ripple effect of indecision, feeding cycle after cycle of stalled pilots and missed breakthroughs.

So, what is the real reason most AI projects fail? And how do a select few manage to break free and thrive? Let’s uncover the hidden patterns and learn from the organizations that have finally cracked the code.

Excellent. Now that we’ve dissected the anatomy of failure, let’s pivot to the solution. This next section reveals what the successful 20% of organizations do differently, using concrete data and examples to make the path to success tangible for the reader.

This section fulfills the promise made in the introduction, starting to close the curiosity gap by revealing the “secrets” of high-performing teams.

The Success Stories: What the Top 20% Do Differently

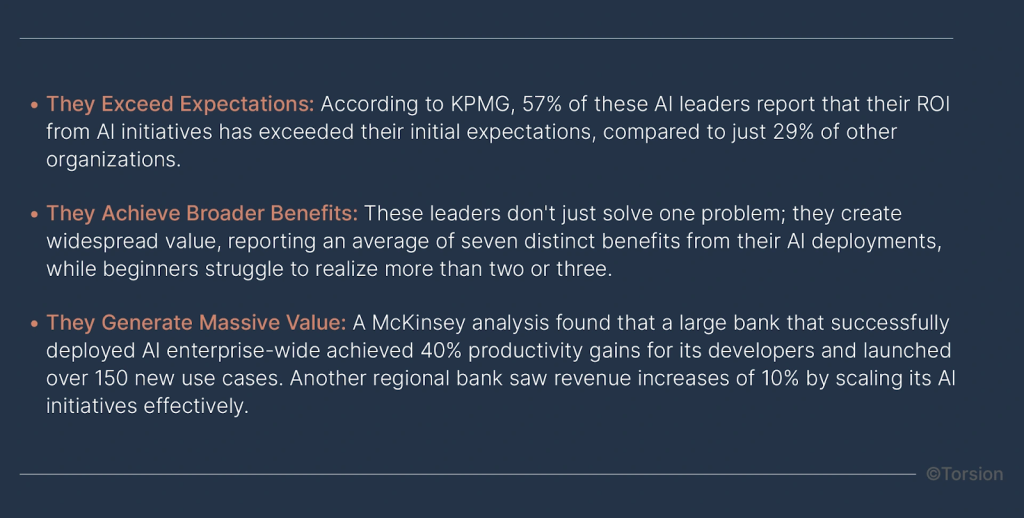

While 80% of financial institutions are caught in the frustrating cycle of pilot purgatory, a select group of high-performers, the top 20% have cracked the code. They operate under a fundamentally different blueprint. They have transformed AI from a costly experiment into a powerful engine for growth and efficiency.

What does their success look like in real numbers?

These results aren’t accidental. They are the direct outcome of a disciplined and strategic approach that addresses the very “silent killers” we identified earlier.

The Sharecare Transformation

Look at the results from Sharecare’s transformation, a leader in the digital health industry. By implementing an end-to-end AI strategy, Sharecare was able to:

- Improve audit processes by 40%.

- Reduce claims processing time by 25%.

These metrics translate directly into millions of dollars in administrative cost savings, the kind of tangible ROI that most organizations only dream of.

So, what is the framework that enables these incredible results? It’s not about buying more software; it’s fundamentally rethinking the AI lifecycle from start to finish.

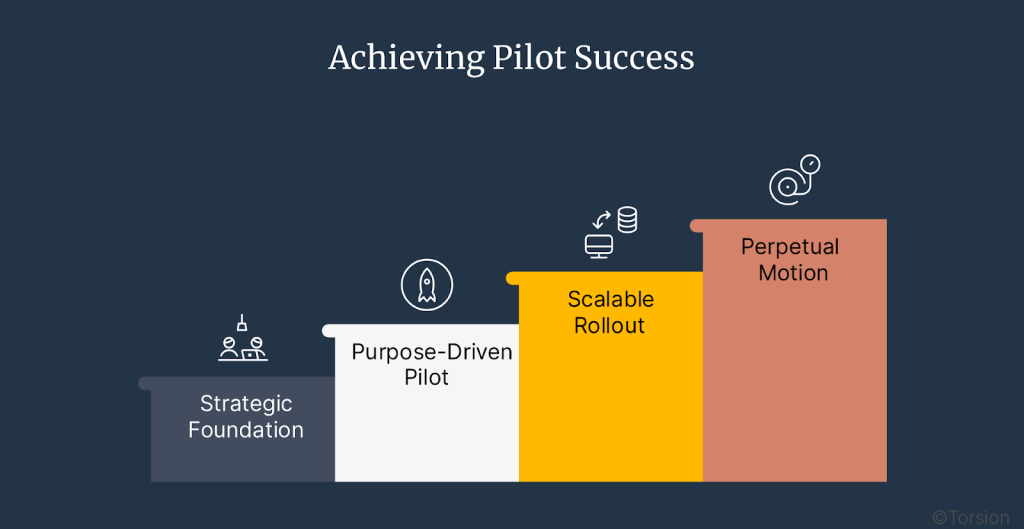

The Escape Framework: The 4-Stage Blueprint to Break Free from Pilot Purgatory

The secret to escaping the costly cycle of failed AI pilots isn’t a single piece of technology or a brilliant, isolated project. It’s a disciplined, end-to-end commitment to mastering the entire AI lifecycle, from initial strategy to long-term governance.

This is the blueprint that the top 20% of financial institutions follow to turn their AI investments into tangible, scalable value.

Stage 1: The Strategic Foundation (Discovery & Strategy)

The journey begins long before any code is written. While over 75% of executives rank AI as a top priority, a shocking 60% of AI projects fail because they don’t align with a core business strategy. Successful organizations refuse to make this mistake.

They start by:

- Aligning All Stakeholders: Facilitating workshops to get business leaders, IT teams, and compliance officers on the same page from day one.

- Identifying High-Impact Use Cases: Pinpointing the one or two areas where AI can deliver the most significant and measurable ROI, rather than boiling the ocean.

- Building a Phased AI Roadmap: Creating a clear, step-by-step plan that integrates with existing systems and is designed to deliver value at each stage, ensuring early wins and sustained momentum.

- Auditing Data Readiness: Proactively addressing data quality issues, like the fact that 80% of enterprise data is unstructured, before they can derail the entire project.

Stage 2: The Purpose-Driven Pilot (Proof of Concept)

A staggering 33% of all data science projects never reach production because they are treated as isolated academic exercises. A Proof of Concept (PoC) should not be a science fair project; it should be a strategic tool for validation.

Torsion’s PoC methodology focuses on:

- Defining Measurable KPIs Upfront: Every pilot must have clear success metrics that are directly tied to business outcomes.

- Building Pragmatic Prototypes: Creating functional models that solve a real-world problem and can be tested by actual end-users, not just data scientists.

- Mitigating Risk Early: Identifying and addressing potential technical, regulatory, and cultural hurdles before a full-scale investment is made, preventing late-stage surprises.

Stage 3: The Scalable Rollout (Enterprise Deployment & Scaling)

The leap from a successful pilot to an enterprise-wide solution is where most organizations falter. This stage requires a different level of engineering and strategic foresight, including:

- Robust, Cloud-Native Infrastructure: Building scalable systems that can handle enterprise-level data volume and user demand without performance degradation.

- Seamless Legacy Integration: Architecting solutions that integrate smoothly with existing banking systems, CRMs, and ERPs, avoiding the “rip-and-replace” trap that paralyzes so many large institutions.

- Embedded Compliance Monitoring: Building automated compliance checks directly into the workflow to satisfy regulators without sacrificing speed or agility.

Stage 4: The Perpetual Motion Machine (Optimization & Governance)

An AI model is not a static asset. Its value degrades over time if it is not constantly monitored and maintained. The final stage of the lifecycle is a continuous loop of:

- Continuous Model Retraining: Automatically updating models with the latest market and transactional data to maintain their accuracy and relevance in a changing world.

- Automated Governance and Auditing: Implementing systems that perpetually monitor for model bias, performance degradation, and compliance drift, ensuring the AI remains fair, accurate, and trustworthy.

- Airtight Data Security: Conducting regular security audits and upholding strict data governance to protect sensitive financial information and maintain the confidence of both customers and regulators.

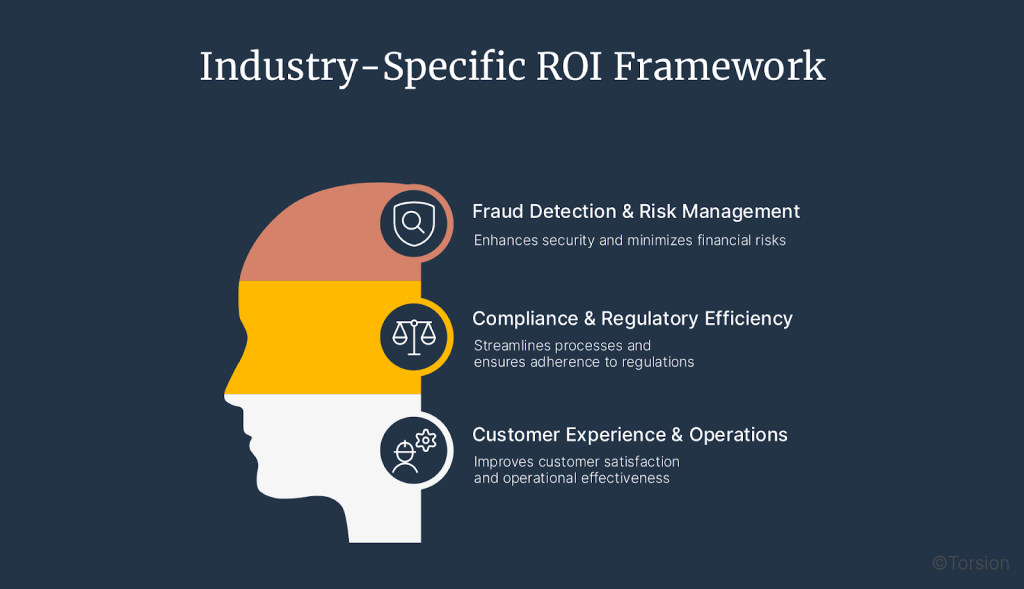

Industry-Specific ROI: Where the Framework Delivers Real Value

This four-stage framework is what drives measurable financial results in the core domains that matter most to financial institutions.

Fraud Detection & Risk Management

By applying a mature AI framework, organizations can move beyond reactive fraud alerts. AI-powered systems can reduce false positives in Anti-Money Laundering (AML) checks by up to 70%, saving millions in wasted manual investigation costs. As financial crime becomes more sophisticated, AI is essential for detecting complex fraudulent patterns in real-time, preventing multi-million dollar losses and reputational damage that legacy systems are blind to.

Compliance & Regulatory Efficiency

Generative AI is poised to cut administrative costs by 30% for large financial firms by 2027, primarily through the automation of complex compliance and reporting tasks. Fully automated AML and Know Your Customer (KYC) screening processes can drastically reduce manual review times and human error, strengthening security while dramatically improving the speed and quality of the customer onboarding experience.

Customer Experience & Operations

Mature AI execution allows you to deliver the personalized, 24/7 service that modern consumers demand. LLM-powered digital assistants can now provide instant, near-human levels of support, freeing up skilled financial advisors and service agents to handle more complex and valuable client issues. Internally, AI-driven personalization engines can accelerate operational decision-making, all while integrating seamlessly with legacy platforms to ensure that existing workflows remain uninterrupted.

Building Your Escape Plan: Actionable Steps for Financial Leaders

Ready to break the cycle and start building a mature AI capability? Here is a practical, four-step plan to move your organization out of the pilot trap and toward transformative AI success.

1. Conduct a Brutally Honest Readiness Assessment

Real transformation starts with a clear-eyed view of where your organization stands today. Go beyond surface-level surveys and conduct a rigorous assessment of your true AI maturity, focusing on:

- Executive AI Literacy: Do your leaders truly understand the risks and opportunities of AI in finance?

- Data Infrastructure: Is your data clean, accessible, and ready for advanced analytics and regulatory scrutiny?

- Compliance Gaps: Are your governance frameworks prepared for automated, explainable decision-making?

Identifying your weakest points is the first, most critical step toward strengthening them.

2. Launch a “Quick Win” Strategic Project

Instead of trying to boil the ocean, identify one or two high-impact use cases where AI can drive a clear and measurable improvement in a short timeframe. Target areas with proven ROI potential, such as reducing loan processing times by 25% or cutting compliance-related administrative costs by 15-20%. A targeted, early success builds the credibility and internal momentum needed for larger, more ambitious initiatives.

3. Design for Scale from Day One

Even when you start with a small pilot, you must think big. Architect your solution with reusable AI components and a scalable, end-to-end analytics pipeline that can be expanded across other departments over time. A phased rollout approach, moving from a single success to enterprise-wide deployment, minimizes risk while maximizing value at each step of the journey.

4. Partner, Don’t Just Build

Recognize that you don’t have to do it all alone. A revealing 61% of high-performing organizations choose to partner with AI specialists who bring proven, deep domain expertise to the table. A smart partnership allows you to accelerate your transformation and avoid the common pitfalls that trap your competitors, all while your internal teams build their own capabilities, creating a powerful hybrid model for long-term, sustainable success.

The Trillion-Dollar Choice Before You

The financial services industry is at a critical inflection point. Global spending on AI is projected to reach an astronomical $1.83 trillion by 2033. The organizations that master the AI lifecycle will capture a massive and enduring competitive advantage, realizing 20%+ reductions in administrative costs and unlocking entirely new revenue streams.

Those that remain stuck in pilot purgatory will see their investments evaporate, falling further and further behind their more agile competitors.

The choice is stark: continue to burn resources on fragmented, dead-end projects, or adopt the disciplined, end-to-end framework that turns AI promises into profitable reality.

Ready to assess your organization’s true AI maturity and build your escape plan? Schedule a no-obligation consultation with Torsion today.

References

- https://www.fintellectai.com/why-80percent-of-ai-projects-in-finance-fail-and-how-to-avoid-it

- https://www.linkedin.com/pulse/why-650-billion-ai-investments-failing-financial-services-patil-pzg3f

- https://invergejournals.com/index.php/ijss/article/view/153

- https://www.akkodis.com/en/newsroom/news/reality-of-ai-strategy-in-entreprise-today

- https://kpmg.com/xx/en/media/press-releases/2024/11/ai-adoption-across-finance-functions-achieves-standout-levels-of-roi.html

- https://www.mckinsey.com/industries/financial-services/our-insights/extracting-value-from-ai-in-banking-rewiring-the-enterprise